Get Pa Dor Rev-1220 As 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA DoR REV-1220 AS online

How to fill out and sign PA DoR REV-1220 AS online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax paperwork can transform into a major hurdle and severe annoyance if proper help is not provided.

US Legal Forms is designed as an online solution for PA DoR REV-1220 AS electronic filing and offers numerous benefits for taxpayers.

Utilize US Legal Forms to guarantee secure and straightforward completion of the PA DoR REV-1220 AS.

- Find the blank form online in the relevant section or through the search engine.

- Press the orange button to open it and wait until it is finished.

- Examine the template and focus on the instructions. If you have never completed the form before, follow the step-by-step directions.

- Pay attention to the highlighted fields. These are editable and require specific information to be entered. If you are uncertain about what to input, refer to the instructions.

- Always sign the PA DoR REV-1220 AS. Utilize the built-in tool to create your electronic signature.

- Click on the date field to automatically insert the correct date.

- Review the document to click and edit it prior to electronic submission.

- Hit the Done button in the top menu once you have finished.

- Save, download, or export the completed document.

How to Modify Get PA DoR REV-1220 AS 2017: Tailor Forms Online

Leverage our powerful online document editor while finalizing your forms.

Complete the Get PA DoR REV-1220 AS 2017, highlight the most significant details, and effortlessly make any other necessary modifications to its content.

Filling out documents digitally not only saves time but also allows you to adjust the template according to your preferences. If you're preparing the Get PA DoR REV-1220 AS 2017, think about utilizing our strong online editing tools.

Our comprehensive online tools are the optimal method to finalize and alter the Get PA DoR REV-1220 AS 2017 tailored to your specifications. Use it to create personal or professional documents from anywhere. Access it in a browser, make any required changes to your documents, and revisit them anytime in the future—all will be securely saved in the cloud.

- Launch the form in the editor.

- Input the required information in the blank fields using Text, Check, and Cross options.

- Follow the form navigation to ensure you don't overlook any mandatory areas in the template.

- Highlight some of the key information and attach a URL to it if necessary.

- Utilize the Highlight or Line features to emphasize the most crucial parts of the content.

- Select colors and thickness for these lines to provide your form with a professional appearance.

- Remove or obscure the details you prefer to keep private.

- Correct content containing mistakes and enter the necessary text.

- Conclude modifications with the Done button once you verify everything is accurate in the form.

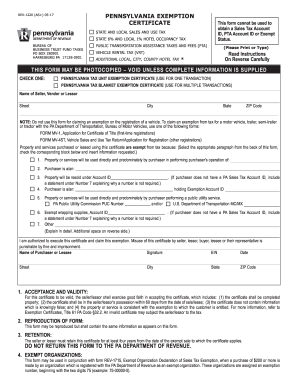

Exemptions from paying Pennsylvania sales tax generally include certain organizations, such as nonprofits, as well as specific transactions. For instance, educational institutions and charitable organizations often qualify for these exemptions. It is crucial to have the PA DoR REV-1220 AS completed to verify your status. Keeping current with regulations can assist in maximizing your tax savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.