Get Pa Dor Rev-183 Ex 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR REV-183 EX online

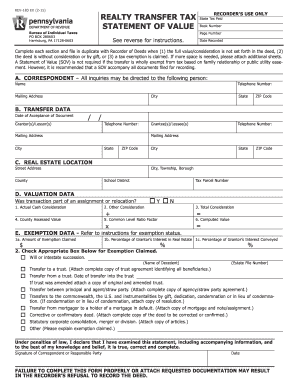

The PA DoR REV-183 EX, also known as the Realty Transfer Tax Statement of Value, is essential for reporting the value of real property transactions in Pennsylvania. This guide provides a step-by-step process to help users complete the form accurately and efficiently online.

Follow the steps to fill out the PA DoR REV-183 EX online

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Section A: Enter the name, address, and telephone number of the person completing the form. This information is vital for any correspondence related to this document.

- Section B: Fill in the Date of Acceptance of Document, which is when the document was accepted by the grantee or lessee. Provide the complete names and addresses of all involved parties, both grantor(s)/lessor(s) and grantee(s)/lessee(s). Use additional sheets if necessary.

- Section C: Identify the real estate by providing the street address, city, township, borough, county, school district, and tax parcel number where applicable.

- Section D: Answer whether the transaction is part of an assignment or relocation. Enter the actual cash consideration received, other forms of consideration, total consideration, the county assessed value, and the common level ratio factor to compute the entire value.

- Section E: If claiming an exemption, fill in the amount and percentage of the exemption, along with selecting the appropriate box that correlates to the exemption being claimed. Ensure to attach all necessary documentation.

- Review all entered information for accuracy, then proceed to save changes, download, print, or share the completed form.

Complete your PA DoR REV-183 EX online today to ensure a smooth property transaction process.

Get form

Related links form

To calculate PA estimated tax payments, start by estimating your annual income to determine your anticipated tax liability. Then, divide this amount by four to find your quarterly payment. Using the PA DoR REV-183 EX can assist in this process, providing a structured way to report your estimates accurately. For peace of mind, many taxpayers turn to uslegalforms for straightforward templates and filing guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.