Loading

Get Pa Dor Rev-545 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR REV-545 online

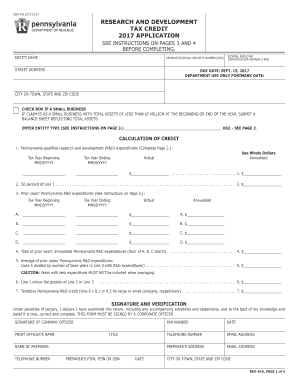

The Pennsylvania Department of Revenue (DoR) REV-545 is a crucial form for organizations seeking tax credits related to research and development expenditures. This guide provides a systematic approach to help users complete the form online with clarity and ease.

Follow the steps to successfully complete the PA DoR REV-545 form.

- Click 'Get Form' button to access the PA DoR REV-545 document. This will allow you to begin filling out the form online.

- Enter the start entity name in the designated field. This is important for identifying your organization within the tax system.

- Provide the Revenue ID or Social Security Number (SSN) as needed. Ensure this information is accurate to avoid potential issues.

- Include the Federal Employer Identification Number (FEIN) in the specified area. This number is crucial for federal tax purposes.

- Mark the checkbox if you are claiming small business status, which requires a balance sheet reflecting total assets of less than $5 million.

- Indicate the entity type by selecting the appropriate category from the list provided.

- Complete the section for Pennsylvania-qualified research and development expenditures by filling in the tax years and corresponding amounts accurately.

- Fill out the calculations of credit section, following the instructions on how to compute lines 1 through 7 carefully. Make sure to keep track of annualized amounts when necessary.

- Proceed to the signature and verification section. Ensure that this form is signed by a corporate officer as required.

- After reviewing all entries for accuracy, users can save the changes, download a copy, print the form, or share it via email.

Complete your research and development tax credit application online today.

Related links form

Filing a Pennsylvania inheritance tax return involves submitting the PA DoR REV-545 form. You will need to gather all relevant documents that reflect the value of the estate and beneficiaries. Ensure that you adhere to all filing deadlines to prevent any delays in the distribution of assets. A well-organized approach can make this process more manageable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.