Get Ca Ftb 541 - Schedule K-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Pmbno online

How to fill out and sign Nonbusiness online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

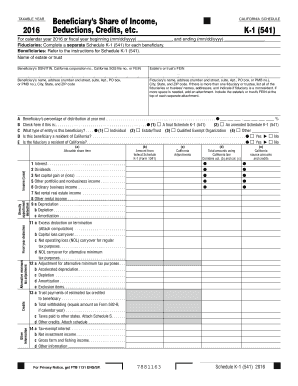

Should the tax period commence unexpectedly or if you simply overlooked it, it might lead to complications for you. CA FTB 541 - Schedule K-1 is not the simplest form, but you have no cause for concern in any circumstance.

By utilizing our expert platform, you will discover how you can finalize CA FTB 541 - Schedule K-1 in situations of urgent time shortage. You merely need to adhere to these straightforward instructions:

With this robust digital solution and its expert tools, submitting CA FTB 541 - Schedule K-1 becomes more convenient. Do not hesitate to try it and spend more time on your hobbies and interests rather than document preparation.

- Launch the document using our specialized PDF editor.

- Complete all the necessary information in CA FTB 541 - Schedule K-1, employing fillable fields.

- Add images, marks, checkboxes, and text boxes, if necessary.

- Repeated information will be inserted automatically after the initial entry.

- If you encounter any difficulties, activate the Wizard Tool. You will receive some advice for simpler completion.

- Remember to include the filing date.

- Create your distinct signature once and place it in all the required spaces.

- Review the details you have entered. Amend errors if necessary.

- Press Done to finalize editing and choose the method by which you will send it. You will have the option to use online fax, USPS, or electronic mail.

- Additionally, you can download the document for later printing or upload it to cloud storage services such as Google Drive, OneDrive, etc.

How to modify Get CA FTB 541 - Schedule K-1 2016: personalize forms online

Place the appropriate document management features at your disposal. Complete Get CA FTB 541 - Schedule K-1 2016 with our reliable tool that integrates editing and eSignature capabilities.

If you wish to implement and sign Get CA FTB 541 - Schedule K-1 2016 online seamlessly, then our web-based solution is the ideal choice. We provide an extensive catalog of template-based forms that can be customized and filled out online. Furthermore, you are not required to print the document or employ external options to render it fillable. All essential tools will be instantly accessible upon opening the file in the editor.

Let's explore our online editing capacities and their primary features. The editor boasts an intuitive interface, so it won't demand much time to understand how to utilize it. We will review three key components that enable you to:

In addition to the mentioned functionalities, you can safeguard your file with a password, apply a watermark, convert the document to the required format, and much more.

Our editor simplifies completing and certifying the Get CA FTB 541 - Schedule K-1 2016. It permits you to accomplish virtually everything regarding forms. Moreover, we consistently ensure that your experience in editing documents is safe and adheres to the significant regulatory standards. All these features make using our solution even more pleasant.

Obtain Get CA FTB 541 - Schedule K-1 2016, implement the necessary modifications and adjustments, and download it in your desired file format. Give it a try today!

- Modify and annotate the template

- The upper toolbar features tools to highlight and obscure text, excluding images and graphic elements (lines, arrows, and checkmarks, etc.), sign, initialize, date the document, and more.

- Arrange your documents

- Utilize the left toolbar if you wish to reorganize the document or delete pages.

- Make them shareable

- If you want to make the template fillable for others and distribute it, you can use the tools on the right to add various fillable fields, signature and date lines, text boxes, etc.

Related links form

A Schedule K-1 for inheritance tax typically refers to information regarding inherited assets that may have tax implications. While inheritances aren’t directly reported on K-1, if you're receiving distributions from an estate or trust, you may encounter a K-1 related to that income. Understanding how to navigate these situations using the CA FTB 541 - Schedule K-1 can help you manage tax liabilities effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.