Loading

Get Pa Ls-1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA LS-1 online

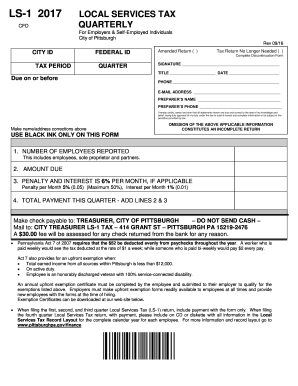

Filing the PA LS-1 form is essential for employers and self-employed individuals within the City of Pittsburgh. This guide provides clear, step-by-step instructions on how to successfully navigate and complete the form online.

Follow the steps to correctly fill out the PA LS-1 online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter the city ID in the designated field. This identifier is crucial for processing your tax return accurately.

- Fill in the tax period and enter your federal ID number. This information helps link your return to your specific tax records.

- Indicate whether this is an amended return or if a tax return is no longer needed by checking the appropriate box.

- Provide the number of employees reported, including sole proprietors and partners, in the section numbered 1.

- Calculate the amount due and write this figure in section 2. Ensure all calculations are accurate to avoid penalties.

- If applicable, calculate and enter any penalties and interest in section 3. This is typically 6% per month, with specifics on penalties included.

- Sum lines 2 and 3 to find the total payment due this quarter. Write this amount in section 4.

- Fill out your contact information, including phone number and email address, on the form.

- Insert your name, title, and date in the signature section to certify that all information provided is true and correct.

- Review the form for completeness and accuracy. Make any necessary corrections to ensure a complete return.

- Once all fields are completed, save changes to your document, then download or print the form. You can also share it as required.

Complete your documents online to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Seniors may need to file PA state income tax depending on their income levels and other factors. Generally, if a senior's income exceeds a specific threshold, they are required to file. For more detailed guidance, you can refer to the PA LS-1 or consult with a tax professional who can assist you with your specific situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.