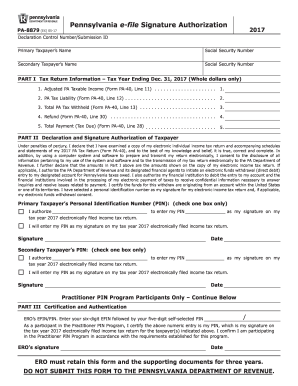

Get Pa Pa-8879 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA PA-8879 online

How to fill out and sign PA PA-8879 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax forms can turn into a major issue and a considerable nuisance if proper assistance is not provided.

US Legal Forms is created as a web-based solution for PA PA-8879 electronic submission and offers multiple advantages for filers.

Click the Done button located in the upper menu once you have finished. Save, download, or export the completed form. Utilize US Legal Forms to ensure a smooth and straightforward PA PA-8879 completion.

- Locate the form on the site in the appropriate category or through the search functionality.

- Press the orange button to access it and wait for it to load.

- Examine the document and adhere to the guidelines. If you haven’t filled out the form before, go by the step-by-step instructions.

- Concentrate on the highlighted sections. These are editable and require specific information to be entered. If you're uncertain about what to input, refer to the guidelines.

- Always ensure to sign the PA PA-8879. Utilize the integrated tool to create your electronic signature.

- Select the date field to automatically enter the appropriate date.

- Review the document to verify and modify it before electronically filing.

How to modify Get PA PA-8879 2017: personalize forms online

Experience a hassle-free and paperless method of modifying Get PA PA-8879 2017. Utilize our dependable online service and save significant time.

Creating each form, including Get PA PA-8879 2017, from the ground up consumes too much time, so having a proven solution of pre-prepared document templates can enhance your productivity.

However, modifying them can pose a challenge, especially with documents in PDF format. Fortunately, our extensive catalog comes with an integrated editor that allows you to swiftly complete and personalize Get PA PA-8879 2017 without the need to leave our site, ensuring that you don’t waste valuable time modifying your forms. Here’s how to work with your form using our solution:

Whether you need to finalize editable Get PA PA-8879 2017 or any other document accessible in our catalog, you are on the right path with our online document editor. It’s simple and secure and doesn’t require any special expertise. Our web-based tool is tailored to handle nearly everything you can imagine regarding document modification and completion.

Stop relying on traditional methods of managing your documents. Opt for a more effective solution to assist you in streamlining your tasks and making them less reliant on paper.

- Step 1. Locate the necessary document on our website.

- Step 2. Click Get Form to access it within the editor.

- Step 3. Take advantage of our expert adjustment features that permit you to insert, delete, annotate, and highlight or black out text.

- Step 4. Generate and affix a legally-binding signature to your form by using the signing option from the upper toolbar.

- Step 5. If the document layout doesn’t appear as you desire, utilize the options on the right to erase, add, and rearrange pages.

- Step 6. Include fillable fields so others can be invited to fill out the document (if applicable).

- Step 7. Distribute or send the form, print it, or select the format in which you’d prefer to receive the document.

When you file your PA tax return, you should attach several documents, including W-2 and 1099 forms. If you are claiming deductions or credits, you may also need to include supporting materials, such as 1098 forms, and other relevant proof of payments. Ensuring you have all the essential paperwork ready helps facilitate a smoother filing experience with your PA PA-8879.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.