Loading

Get Pa Rct-101d 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA RCT-101D online

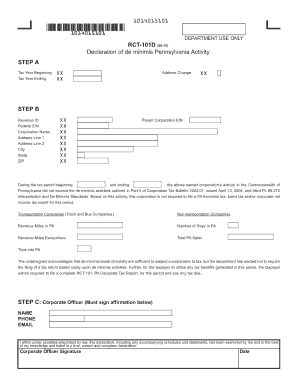

The PA RCT-101D is a declaration form used by corporations in Pennsylvania to report de minimis activities. This guide will walk you through the process of filling out the form online, ensuring you complete it accurately and efficiently.

Follow the steps to complete the PA RCT-101D form.

- Click the ‘Get Form’ button to obtain the PA RCT-101D form and open it in your online document editor.

- In Step A, enter the tax year information. Fill in the tax year beginning and ending dates where indicated.

- If there is an address change, indicate this in the designated section.

- In Step B, provide your Revenue ID, Federal EIN, corporation name, address (including address line 1 and 2), city, state, and ZIP code.

- If applicable, enter the parent corporation EIN.

- Report the activity details during the specified tax period, confirming that it did not exceed the de minimis activities as outlined in the Corporation Tax Bulletin.

- For transportation companies, fill out the revenue miles in Pennsylvania, number of days in Pennsylvania, revenue miles everywhere, total Pennsylvania sales, and trips into Pennsylvania.

- In Step C, provide the name, phone number, and email of the corporate officer who will affirm the declaration.

- The corporate officer must sign the declaration, indicating the date of signing.

- Once all fields are completed, review the information for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your documents online today to ensure compliance and ease of access.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The PA franchise tax is a privilege tax imposed on businesses for the privilege of doing business in Pennsylvania. It applies to corporations, including limited liability companies, and is calculated based on the company's capital stock value or a flat rate. If you need assistance navigating the complexities of the PA franchise tax, uslegalforms can provide resources and tools to help simplify the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.