Loading

Get Pa Schedule Pa-40x 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Schedule PA-40X online

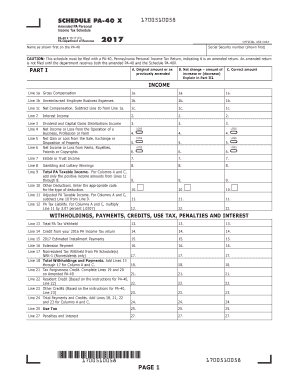

This guide provides step-by-step instructions for completing the PA Schedule PA-40X online, which is used to amend your PA Personal Income Tax Return. Whether you are making adjustments to income, deductions, or credits, this guide aims to simplify the process.

Follow the steps to fill out your PA Schedule PA-40X accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editing tool.

- Enter your Social Security number and name as it appears on your original PA-40 in the designated fields.

- In Part I, list the original amounts from your previous PA-40 or the most recently amended return in Column A for income and deductions. For any changes, input the net amount in Column B and the corrected total in Column C.

- For lines related to Gross Compensation (Line 1a) through Total PA Taxable Income (Line 9), input the matching figures from the original return and adjust as necessary based on your amendments.

- Move to Part II to calculate your refund or any tax payment due. Use the provided lines to enter figures from your amended tax liability and total payments.

- In Part III, provide a clear description or explanation of the changes made. This should include any modifications to income, deductions, or filing status.

- Once all sections are completed, review the information provided, make any necessary adjustments, and save your changes.

- You can now download, print, or share the filed PA Schedule PA-40X as required.

Complete your PA Schedule PA-40X online today to ensure your tax records are accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Any Pennsylvania resident who earns income, including wages, self-employment income, or interest, must file a PA-40. Additionally, non-residents who earn income from Pennsylvania sources are also required to file. It's important to comply with these regulations to avoid any penalties regarding your PA Schedule PA-40X. Review the filing requirements thoroughly to ensure compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.