Loading

Get Pa Schedule Rk-1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Schedule RK-1 online

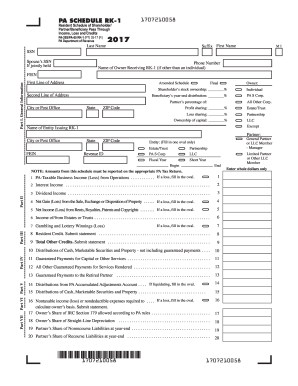

The PA Schedule RK-1 is a crucial document used by partnerships and S corporations in Pennsylvania to report income and losses for resident owners. This guide aims to provide clear instructions to help users accurately complete the form online.

Follow the steps to successfully complete the PA Schedule RK-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Part I: General Information. Enter the appropriate information including last name, Social Security number (SSN), and the spouse’s SSN if applicable. Fill out the FEIN and street address accurately, ensuring that all required fields are filled according to the guidelines.

- In Part II, provide the owner’s distributive share of Pennsylvania-source income (loss). Be sure to include the appropriate figures from your financial documents, marking any losses as necessary.

- Fill out Part III, which requires entering the owner’s share of Pennsylvania credits. If seeking credits, ensure to submit any required statements that provide detailed breakdowns.

- For Part IV, report distributions from the partnership, ensuring to categorize payments appropriately and mark them based on their nature.

- In Part V, indicate any nontaxable income or nondeductible expenses. This helps in calculating the owner’s basis, so accuracy is key.

- Finally, review all completed sections for accuracy. Save changes, and if you need to, download, print, or share the completed form as necessary.

Complete your PA Schedule RK-1 online to ensure accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Absolutely, PA taxes can be filed electronically, making it a convenient option for many taxpayers. Electronic filing streamlines the process, often leading to faster refunds and easier tracking of your submission. Tools and resources available through UsLegalForms can guide you in preparing and filing your taxes effectively online.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.