Loading

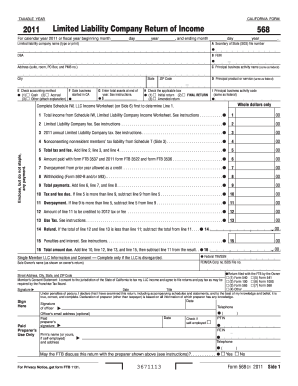

Get Ca Ftb 568 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 568 online

Filling out the CA FTB 568 form online can seem daunting, but with the right guidance, it becomes manageable. This guide provides clear, step-by-step instructions to assist you in completing the form effectively.

Follow the steps to fill out the CA FTB 568 online.

- Click 'Get Form' button to obtain the CA FTB 568 form and open it in the editor.

- Indicate the taxable year for which you are filing by filling in the relevant information for either calendar year or fiscal year.

- Provide the Secretary of State file number and the Federal Employer Identification Number (FEIN).

- Specify the principal business activity name and principal product or service that aligns with the information provided on the federal forms.

- Fill in the date the business started operating in California and provide the total assets at the end of the year.

- Complete the LLC fee and California annual tax amounts as detailed in the instructions provided in the booklet.

- Review all entries for accuracy, ensuring that calculations are correct.

Start filling out your CA FTB 568 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

As the owner of a single-member LLC, you do not file taxes separately from your LLC. The LLC's income is reported on your personal tax return. However, you must still adhere to the filing requirements of Form CA FTB 568. Using a reliable service like uslegalforms can simplify this tax process for you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.