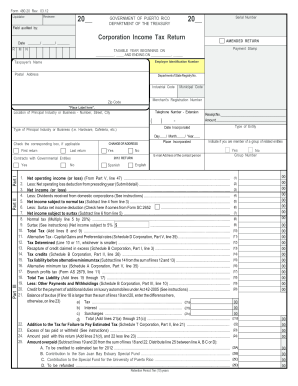

Get Pr 480.20 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PR 480.20 online

How to fill out and sign PR 480.20 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can turn into a major issue and a huge hassle if there is no proper support available. US Legal Forms has been created as an online solution for PR 480.20 electronic filing and provides numerous advantages for the taxpayers.

Utilize the advice on how to fill out the PR 480.20:

Click the Done button in the upper menu once you have completed it. Save, download, or export the finished form. Utilize US Legal Forms to ensure an easy and convenient PR 480.20 completion.

- Locate the template on the website in the appropriate section or through the search feature.

- Click the orange button to access it and wait for the process to complete.

- Examine the blank form and adhere to the instructions. If you haven't filled out the template before, follow the step-by-step directions.

- Focus on the highlighted fields. They are editable and require specific information to be entered. If you are uncertain about what information to provide, consult the guidelines.

- Always sign the PR 480.20. Use the built-in tool to create the electronic signature.

- Select the date field to automatically insert the correct date.

- Review the document to press and adjust it prior to submitting.

How to Modify Get PR 480.20 2012: Personalize Forms Online

Forget the conventional paper-based method of processing Get PR 480.20 2012. Complete the document quickly and securely with our professional web-based editor.

Are you required to alter and fill out Get PR 480.20 2012? With an expert editor like ours, you can accomplish this in just a few minutes without needing to print and scan documents back and forth. We offer entirely customizable and user-friendly document templates that will assist you in completing the essential online document.

All forms, by default, come equipped with fillable fields that you can engage once you access the form. However, if you wish to enhance the current content of the document or add new elements, you can select from various editing and annotation tools. Emphasize, obscure, and annotate the text; insert checkmarks, lines, text boxes, images, notes, and comments. Furthermore, you can effortlessly validate the form with a legally-binding signature. The finalized document can be shared with others, stored, sent to external applications, or converted into any other format.

You’ll never regret using our online tool to process Get PR 480.20 2012 because it's:

Don't waste time modifying your Get PR 480.20 2012 the old-fashioned way - with pen and paper. Opt for our comprehensive solution instead. It provides you with a diverse range of editing features, built-in eSignature functionality, and user-friendliness. One of its key advantages is the ability for team collaboration - you can work together on documents with anyone, establish a well-organized document approval process from scratch, and much more. Experience our online solution and obtain the best value for your investment!

- Simple to establish and use, even for those who haven’t processed documents online before.

- Powerful enough to handle various editing requirements and document types.

- Reliable and secure, ensuring your editing experience is protected every time.

- Accessible on multiple devices, making it easy to complete the document from any location.

- Able to generate forms based on pre-designed templates.

- Compatible with a wide range of file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

To qualify for full tax benefits in Puerto Rico, you typically need to be physically present for at least 183 days during the tax year. This duration allows you to establish residency and take advantage of the lower local tax rates. Filing the PR 480.20 is essential in this process to properly document your residential status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.