Get Pr 480.20(cpt) 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.20(CPT) online

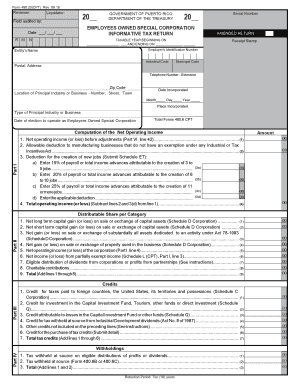

Filling out the PR 480.20(CPT) form online can streamline the process of submitting your informative tax return as an Employees Owned Special Corporation. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently, ensuring that all necessary information is reported correctly.

Follow the steps to complete your PR 480.20(CPT) online.

- Click the ‘Get Form’ button to access the PR 480.20(CPT) online. This will allow you to open the form in an interactive editor for easy completion.

- Enter the basic information at the top of the form including the corporation's name, employer's identification number, and postal address.

- Indicate the taxable year by filling in the beginning and ending dates unless it is a calendar year.

- Complete Part I by calculating the net operating income or loss. Input the necessary amounts as required for deductions relevant to your manufacturing business.

- Fill out Part II, detailing the distributable share per category by entering the net long and short-term capital gains or losses.

- Proceed to Part III to list any applicable tax credits. Ensure that you provide all required documentation to validate the credits claimed.

- In Part IV, report the withholdings by entering the amounts associated with eligible distributions for profits or dividends.

- Complete Part V, which focuses on gross profit on sales and income. Enter the corresponding figures for costs and profits.

- In Part VI, enter all deductions related to operations, ensuring that all relevant costs are detailed accurately.

- Finalize the form by reviewing all parts for accuracy. Once complete, save your changes. You can download, print, or share the form as needed.

Complete your PR 480.20(CPT) online to ensure a smooth and efficient tax filing process.

Get form

Non-residents are typically taxed on income sourced from within the state where they earn it. This can include wages, business income, and certain types of investment income. Familiarize yourself with state laws, including those related to PR 480.20(CPT), to ensure you're reporting income accurately. Proper understanding helps minimize unexpected tax liabilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.