Loading

Get Pr 480.6d 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.6D online

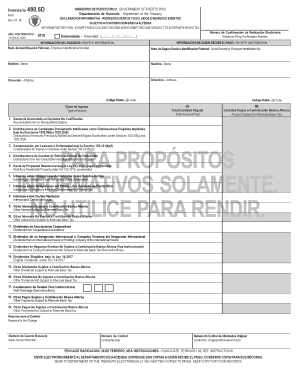

Filling out the PR 480.6D form online can seem complex, but with clear guidance, you can easily provide the necessary information regarding exempt and excluded income. This comprehensive guide will walk you through each step to ensure that your filing is accurate and compliant.

Follow the steps to successfully complete the PR 480.6D online.

- Click the ‘Get Form’ button to access the PR 480.6D form and open it in your preferred online document editor.

- Enter the taxable year in the designated field, indicating the year for which you are reporting exempt income.

- Provide the electronic filing confirmation number in the relevant section for tracking your submission.

- For the payee's information, include the name, address, and identification numbers accurately. This section is crucial for identifying the recipient of the payment.

- Complete the payer's information, which includes details similar to the payee's section, ensuring that the employer identification number or social security number is correctly entered.

- In the 'Total Amount Paid' section, document the total amount that was paid to the payee for the taxable year.

- For the 'Type of Income' section, categorize the income according to the 19 boxes available. Provide specific details such as accumulated gain on nonqualified options or distributions from retirement accounts as applicable.

- In each corresponding box, fill out the amounts that are either subject to the alternate basic tax or not, according to the type of income being reported.

- If any changes are required to previous submissions, clearly indicate the reasons for the change in the specified field.

- Once all the fields are accurately filled out, review your entries for completeness and correctness before submitting.

- Save your changes, and download, print, or share the PR 480.6D form as needed, ensuring you retain a copy for your records.

Start filling out your PR 480.6D form online to ensure timely compliance with tax reporting requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filling out your tax withholding form, start by ensuring all your personal information is correct and current. Next, review the exemption options based on your tax situation. An accurately completed form, like the PR 480.6D, will help ensure your tax withholdings meet your needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.