Loading

Get Wv Dor It-140 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV DoR IT-140 online

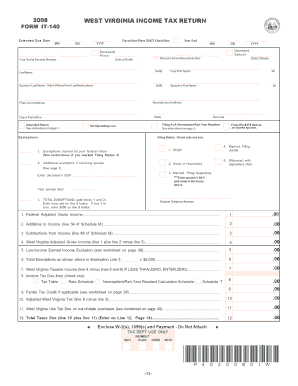

This guide provides a detailed overview of how to complete the WV DoR IT-140 form online. By following these clear instructions, you can navigate through each section and field of the form with ease, ensuring an accurate and timely submission.

Follow the steps to complete the WV DoR IT-140 online efficiently.

- Press the ‘Get Form’ button to access the form and open it in the designated editor.

- Begin by entering your first name at the top of the form, followed by your last name and any applicable suffix.

- Input your Social Security Number in the designated field to the right.

- If applicable, fill in your spouse's information, including their last name, first name, Social Security Number, and date of death if relevant.

- Indicate your filing status by selecting one of the options provided: Single, Head of Household, Married Filing Jointly, or another applicable status.

- For the income section, report your Federal Adjusted Gross Income in the corresponding box.

- List any additions to your income and subtractions from your income, as specified, and calculate your West Virginia Adjusted Gross Income.

- Enter the total exemptions you are claiming, and calculate your taxable income based on the provided guidelines.

- Complete the section regarding your tax liability by determining your total tax due using the applicable tables provided.

- Finally, after reviewing all entries for accuracy, save your changes, and download or print the completed form for your records.

Begin filling out your WV DoR IT-140 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out the FW-4 form is straightforward, as it serves to determine your withholding allowances for state income tax. Start by entering your personal information, such as your name and address. Then, claim your allowances based on your financial situation. This form plays a crucial role in ensuring accurate tax withholding and helps you manage your state taxes effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.