Loading

Get Pr 480.70(oe) 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.70(OE) online

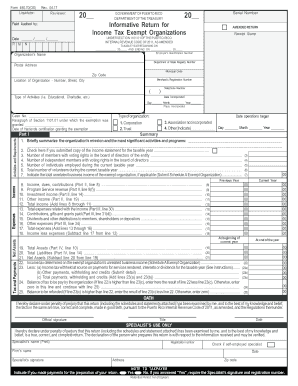

The PR 480.70(OE) form is essential for income tax exempt organizations in Puerto Rico to report their financial activities. This guide provides a clear and supportive step-by-step approach to help users complete the form online effectively.

Follow the steps to fill out the PR 480.70(OE) online.

- Click ‘Get Form’ button to access the PR 480.70(OE) document and open it in the editor.

- Fill in the heading of the form by entering the taxable year dates and the organization’s name, postal address, and identification numbers.

- Specify the type of organization by checking the appropriate box and providing the details of incorporation, if applicable.

- Complete Part I by summarizing the organization’s mission and activities. Make sure to include the number of members and volunteers.

- Provide the organization's financial data in Part II, which includes income, dues, contributions, and expenses. Carefully enter each amount as required.

- Complete Part III detailing the declared income and the corresponding expenses. Ensure all calculations are accurate.

- Review Part IV for the balance sheet, confirming the total assets and liabilities align with the organization’s accounting records.

- Conclude by signing and dating the form, ensuring that a duly authorized individual validates it. If prepared by a specialist, confirm their registration details are included.

- Save changes to the form, then download, print, or share it as necessary for your records.

Complete your PR 480.70(OE) form online today to ensure compliance and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To qualify for tax benefits under PR 480.70(OE), you typically need to reside in Puerto Rico for at least 183 days in a calendar year. Establishing a bona fide residence is key to gaining access to these tax privileges. Consulting with tax professionals can help ensure that you meet all necessary requirements for eligibility.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.