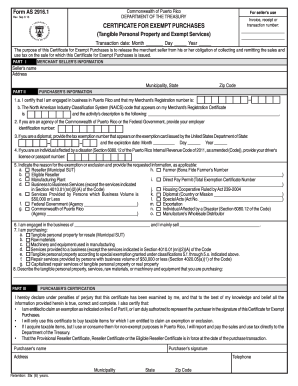

Get Pr As 2916.1 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PR AS 2916.1 online

How to fill out and sign PR AS 2916.1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can become a considerable obstacle and a major frustration if no suitable help is provided. US Legal Forms has been developed as a web-based solution for PR AS 2916.1 electronic filing and provides numerous benefits for taxpayers.

Follow these suggestions on how to complete the PR AS 2916.1:

Use US Legal Forms to guarantee safe and straightforward completion of PR AS 2916.1.

Locate the template online in the designated section or through a search engine.

Press the orange button to access it and wait for the loading process to finish.

Review the form and adhere to the guidelines. If you have not filled out the template previously, follow the step-by-step instructions.

Pay attention to the highlighted fields. They are editable and require specific details to be entered. If you're unsure about what information to provide, refer to the instructions.

Make sure to sign the PR AS 2916.1. Utilize the integrated tool to create your e-signature.

Select the date field to automatically populate the correct date.

Re-examine the template to verify and amend it prior to submission.

Hit the Done button in the upper menu when you have completed it.

Save, download, or export the finalized template.

How to amend Get PR AS 2916.1 2013: personalize forms online

Select the correct Get PR AS 2916.1 2013 template and modify it immediately. Streamline your documentation with an intelligent document editing tool for online forms.

Your everyday process with documents and forms can be more productive when everything you require is consolidated in one location. For instance, you can locate, retrieve, and adjust Get PR AS 2916.1 2013 in just a single browser tab. Should you need a specific Get PR AS 2916.1 2013, you can swiftly find it using the intelligent search engine and access it right away. There’s no need to download it or seek a third-party editor to modify it and insert your information. All the tools for effective operation are included in one complete solution.

This editing solution enables you to alter, complete, and endorse your Get PR AS 2916.1 2013 form directly on site. Once you find a suitable template, click on it to enter the editing mode. Upon opening the form in the editor, all the necessary tools are at your disposal. You can conveniently fill in the designated areas and delete them if required with the aid of a straightforward but versatile toolbar. Implement all modifications instantly, and sign the document without leaving the tab by simply clicking the signature field. Following that, you can send or print your document if needed.

Make additional personalized adjustments with the available tools.

Uncover new possibilities in organized and uncomplicated documentation. Locate the Get PR AS 2916.1 2013 you require within moments and complete it in the same tab. Eliminate the clutter in your paperwork permanently with the assistance of online forms.

- Annotate your document with the Sticky note tool by placing a note at any location within the file.

- Insert essential graphic elements if necessary, using the Circle, Check, or Cross tools.

- Alter or incorporate text anywhere in the file utilizing the Texts and Text box tools. Include content with the Initials or Date tool.

- Revise the template text with the Highlight and Blackout, or Erase tools.

- Insert custom graphic elements using the Arrow and Line, or Draw tools.

Related links form

Becoming a permanent resident in Puerto Rico involves applying through the appropriate federal channels and fulfilling any residency requirements. You should provide documentation that asserts your continuous residency and eligibility. Utilizing the resources available from PR AS 2916.1 can aid in effectively establishing your residence.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.