Get Pr Sc 2745 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2745 online

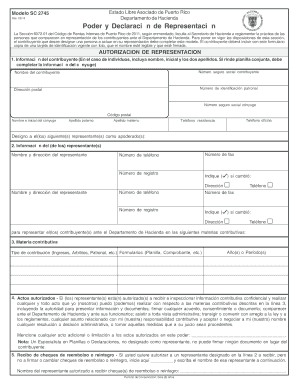

Filling out the PR SC 2745 form online can be a straightforward process with the right guidance. This document is essential for designating a representative to act on your behalf before the Puerto Rico Department of Hacienda.

Follow the steps to complete the PR SC 2745 form successfully.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering your personal information in the 'Información del contribuyente' section. This includes your full name, social security number, and postal address. If you are filing jointly, also include your partner's details.

- In the 'Información del (de los) representante(s)' section, provide the name and address of the representative you are designating, along with their phone number and registration number.

- Specify the 'Materia contributiva' where you need representation. Indicate the type of contribution, relevant forms, and corresponding years or periods.

- Review the section on ' autorizados' to confirm that the representative is authorized to access confidential information and perform various acts on your behalf. Mention any limitations or additional acts you wish to specify.

- Specify if you wish to authorize any representative to receive refunds in the 'Recibo de cheques de reembolso' section. Provide their name if applicable.

- Decide how notifications will be handled by marking the appropriate boxes in the 'Notificaciones y comunicaciones' section.

- In the 'Revocación de las autorizaciones de representación anteriores' section, indicate if you wish to revoke any previous authorizations by marking the appropriate box.

- Sign the document in the 'Firma del contribuyente' section. If applicable, include your partner's signature as well. The form must be dated, and unsigned or undated forms will be returned.

- The representative must complete their declaration section, including their name, jurisdiction or registration number, and signature, ensuring they have proper identification ready to present.

- Finally, you can save your changes, download the form, print it out, or share it as needed.

Complete your PR SC 2745 form online today for a smoother process.

Get form

To avoid capital gains tax in Puerto Rico, you generally need to reside on the island for at least 183 days in a year. This requirement aligns with the PR SC 2745 rules, which cater to individuals looking to benefit from a lower tax environment. Establishing your domicile is crucial to ensuring compliance and capitalizing on tax savings. If you’re considering relocating, USLegalForms can assist you in the process and guide you through any necessary documentation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.