Loading

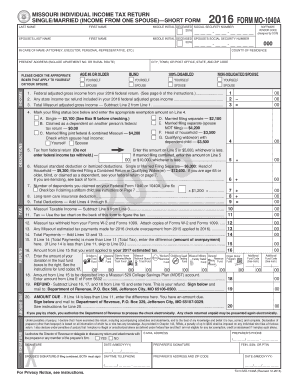

Get Mo Form Mo-1040a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form MO-1040A online

Filling out the MO Form MO-1040A online can simplify the process of filing your Missouri individual income tax return. This guide provides clear instructions to help you navigate each section of the form effectively.

Follow the steps to complete your MO Form MO-1040A online

- Click ‘Get Form’ button to acquire the form and access it in your editor.

- Begin by entering your last name, first name, and middle initial in the designated fields at the top of the form. Provide your social security number, and if applicable, the last name, first name, middle initial, and social security number of your spouse.

- Fill in the ‘In care of name’ if someone is assisting you, followed by your current address including any apartment number or rural route.

- Indicate any applicable boxes related to your age, disability status, or marital status. Check the relevant boxes for yourself and your spouse.

- Report your federal adjusted gross income from your federal return. If applicable, also report the state income tax refund included in your federal income.

- Complete line 4 by marking your filing status and entering the appropriate exemption amount.

- Enter the tax amount from your federal return as instructed, ensuring it does not exceed specified limits.

- If itemizing, calculate and enter your itemized or standard deductions based on your filing status and age. Follow any notes for additional deductions if applicable.

- List the number of dependents claimed on your federal return and complete the tax calculation according to the specified tax chart.

- Review your total payments, which includes Missouri taxes withheld and any estimated payments you've made.

- Calculate if you are due a refund or if you owe taxes using the provided lines; make sure to carefully follow the instructions for each scenario.

- Sign the form confirming that all information is complete and accurate. Provide your email address, and if applicable, your preparer’s information.

- Finalize your documents by saving any changes. You can then download, print, or share the completed form as needed.

Start filling out your MO Form MO-1040A online to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 1040A was often referred to as the 'short form' for federal income tax returns. It simplified the filing process for those who qualified with basic tax situations. Although it's no longer in use, individuals can still utilize MO Form MO-1040A for their Missouri income tax return, offering a similar ease of use.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.