Loading

Get Ri Dot Ri-100a 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI DoT RI-100A online

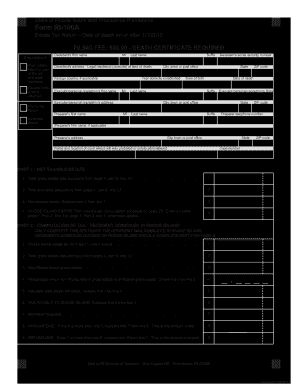

This guide provides clear and supportive instructions on completing the RI DoT RI-100A Estate Tax Return online. Designed for users of varying experience levels, it will walk you through each section of the form with detailed assistance.

Follow the steps to successfully complete your RI-100A form.

- Click ‘Get Form’ button to obtain the RI DoT RI-100A and open it in your editor.

- In the Decedent's section, enter the first and last name, legal residence, and date of birth of the decedent. Include the date of death and social security number.

- Fill out the Executor's section with their name, address, and social security number. Ensure accuracy to facilitate communication regarding the estate.

- Complete Part 1 - Net Taxable Estate by calculating total gross estate and allowable deductions, leading to the net taxable estate.

- If the decedent was domiciled in Rhode Island, proceed with Part 2. If not, move to Part 3. Here, calculate the relevant taxes, deductions, or refunds due.

- In Part 4, affirm any elections by the executor regarding valuation or treatment of the estate.

- Complete the General Information section in Part 5, providing details on marital status, death certificate number, and other relevant information.

- Detail specific assets in the respective sections such as real estate, stocks, and other property, attaching additional sheets if necessary.

- Finish by reviewing your entries for accuracy. Save your work, and once completed, download, print, or share the document as necessary.

Complete your RI DoT RI-100A online now to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can file a state tax extension online in Rhode Island. This method allows you to submit your extension quickly and securely, minimizing paperwork. Online filing can be particularly advantageous during peak tax season when time is limited. Refer to the RI DoT RI-100A for comprehensive instructions on how to proceed.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.