Loading

Get Ri Dot Ri-100a 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI DoT RI-100A online

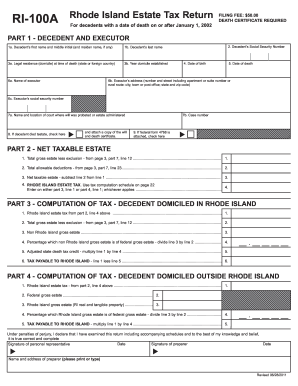

The Rhode Island Estate Tax Return (Form RI-100A) is a crucial document for managing the estate of a decedent. This guide will help you navigate the online filling process to ensure a smooth submission.

Follow the steps to complete the RI DoT RI-100A effectively.

- Press the ‘Get Form’ button to access the RI-100A online form.

- Begin with Part 1, where you will input the decedent’s details. Start with the first name, middle initial, last name, and maiden name if applicable. Ensure accuracy in the names as these are critical identifiers.

- Next, provide the legal residence of the decedent at the time of death, including the state or foreign country, and the year the domicile was established.

- In Part 1, also input the decedent’s Social Security Number, date of birth, and date of death. It’s essential to double-check these dates for accuracy.

- Fill in the details regarding the executor, including the name, address, and Social Security Number. This individual is responsible for managing the estate.

- For Part 2, calculate the total gross estate less exclusions and the total allowable deductions listed on the specified lines from the form. Ensure to perform accurate calculations to determine the net taxable estate.

- Continue to Parts 3 and 4, where you will compute the estate tax depending on whether the decedent was domiciled in Rhode Island or outside the state. Follow the instructions closely for these calculations.

- In Part 5, answer yes or no to the elections by the executor regarding alternative valuations and special use valuations.

- Complete Part 6, which gathers general information. Attach any necessary supplemental documents, including the death certificate.

- Finally, review all information entered across the form for accuracy, then save your changes, and download or print the completed RI-100A form for your records.

Complete your RI DoT RI-100A online today and ensure your estate matters are handled efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Rhode Island probate, the inventory tax refers to the fees associated with listing and appraising estate assets. This tax is typically calculated based on the value of the estate's total assets. Understanding this tax can help you anticipate costs during the probate process. For comprehensive guidance, check uslegalforms for tools and templates to manage estate inventory effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.