Loading

Get Ri Dot Ri-1040 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI DoT RI-1040 online

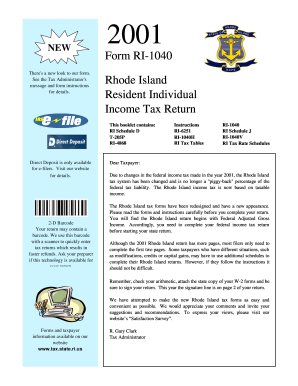

The RI DoT RI-1040 is the Rhode Island resident individual income tax return form. This guide provides clear, step-by-step instructions for filling out the form online to ensure a smooth and efficient filing process.

Follow the steps to complete your RI DoT RI-1040 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information at the top of the form, including your name, address, and social security number. Ensure all details are accurate.

- Indicate your filing status by checking the appropriate box. Choose from options such as 'Single', 'Married filing jointly', 'Head of household', etc.

- Report your Federal Adjusted Gross Income (AGI) from your Federal Form 1040. Enter this amount in the designated field.

- If applicable, complete any modifications to your Federal AGI as indicated on Schedule I. This includes adding or subtracting amounts based on Rhode Island tax regulations.

- Calculate your Rhode Island taxable income by entering the necessary deductions and exemptions based on your Federal AGI.

- Determine your Rhode Island income tax using the RI Tax Table or other applicable schedules like RI Schedule D or J.

- If you have any credits available, ensure you complete the relevant sections on pages 2 and 3 of the form.

- Review all calculations for accuracy and completeness, ensuring your math is correct.

- Sign and date the return. Ensure any necessary attachments, such as W-2 forms, are included.

- Finally, you can save changes, download, print, or share the completed form as necessary.

Complete your RI DoT RI-1040 form online today for a hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You should send your completed RI-1040 form to the address specified by the Rhode Island Division of Taxation. Often, this is the main tax office in Providence. To ensure your form reaches its destination without a hitch, double-check the RI DoT guidelines, and consider sending your return via certified mail for tracking purposes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.