Loading

Get Ri Dot Ri-1040nr 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI DoT RI-1040NR online

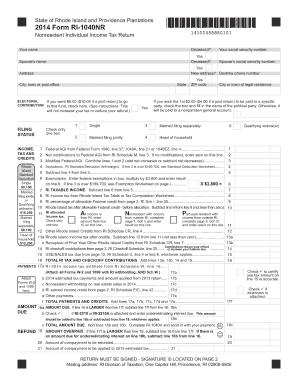

The RI DoT RI-1040NR is an essential form for nonresident individuals to report their income and calculate their tax liabilities for Rhode Island. This guide will provide clear, step-by-step instructions to help users fill out the form online easily and accurately.

Follow the steps to complete your RI DoT RI-1040NR form online.

- Click ‘Get Form’ button to access the RI DoT RI-1040NR form and open it in your preferred editor.

- Enter your name and social security number in the designated fields. If applicable, indicate if you or your spouse is deceased.

- Provide your address, city, town, ZIP code, and a daytime phone number. If you have a new address, mark the appropriate box.

- Select your filing status by checking the appropriate box: single, married filing jointly, married filing separately, or head of household.

- Complete the income section by entering your federal adjusted gross income (AGI) from your federal tax return.

- Make any necessary modifications to your federal AGI to arrive at the modified federal AGI and enter it in the respective field.

- Calculate your Rhode Island standard deduction and enter the amount on the form, based on your filing status.

- Input the number of exemptions and calculate the total exemptions allowable. Enter that amount on the form.

- Calculate your Rhode Island taxable income by subtracting your deductions and exemptions from your modified federal AGI.

- Use the Rhode Island tax table to determine your state income tax and enter that amount on the form.

- Complete any applicable credits and adjustments, including contributions to checkoff funds.

- Fill out the payments section, including any tax withheld and any estimated payments made for the tax year.

- Review the entire form for accuracy and completeness. Save your changes.

- Once satisfied, download or print the form for your records, and follow directions for submission.

Start completing your RI DoT RI-1040NR form online today to ensure a smooth filing process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Rhode Island, senior citizens may qualify for property tax relief through various programs aimed at reducing expenses. These initiatives often include credits and exemptions based on income and property value. Seniors should integrate their applications for these benefits with their tax filings, particularly when completing the RI DoT RI-1040NR.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.