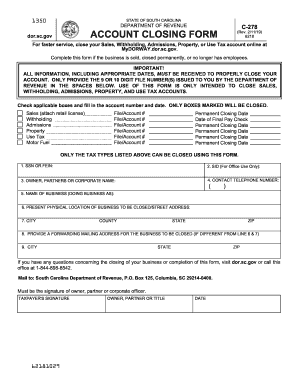

Get Sc Dor C-278 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SC DoR C-278 online

How to fill out and sign SC DoR C-278 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing a tax document can turn into a major hurdle and severe nuisance if proper support is not offered.

US Legal Forms has been developed as an online solution for SC DoR C-278 e-filing and provides several benefits for taxpayers.

Hit the Done button on the top menu once you have completed it. Save, download, or export the finished form. Utilize US Legal Forms to ensure a smooth and effortless SC DoR C-278 completion.

- Access the blank form on the website in the designated section or through the Search engine.

- Click the orange button to open it and wait for it to load.

- Examine the blank form and pay attention to the instructions. If you have not completed the template before, follow the line-by-line directions.

- Concentrate on the highlighted fields. They are fillable and require specific information to be entered. If you are uncertain about what details to input, refer to the guidelines.

- Always sign the SC DoR C-278. Use the built-in tool to create the e-signature.

- Select the date field to automatically fill in the appropriate date.

- Review the document to verify and edit it before submission.

How to modify Get SC DoR C-278 2019: personalize forms online

Explore a singular service to handle all your documentation seamlessly. Locate, modify, and complete your Get SC DoR C-278 2019 in one platform with the assistance of intelligent tools.

The days when individuals had to print forms or manually fill them out are behind us. Today, all it requires to obtain and complete any document, like Get SC DoR C-278 2019, is opening just a single browser tab. Here, you can access the Get SC DoR C-278 2019 form and adjust it however you require, from entering text directly into the document to sketching it on a digital sticky note and attaching it to the file. Discover tools that will simplify your documentation without excess effort.

Tap the Get form button to prepare your Get SC DoR C-278 2019 documentation swiftly and begin altering it immediately. In the editing mode, you can effortlessly populate the template with your information for submission. Just select the area you wish to modify and input the data right away. The editor's interface does not require any specialized abilities to navigate. Once you’ve completed the modifications, verify the information's correctness one last time and sign the document. Click on the signature field and follow the directions to eSign the form in no time.

Utilize additional tools to personalize your form:

Completing Get SC DoR C-278 2019 forms will never be challenging again if you know where to find the appropriate template and prepare it swiftly. Do not hesitate to attempt it yourself.

- Employ Cross, Check, or Circle tools to identify the document's information.

- Insert text or fillable text fields with text customization tools.

- Remove, Highlight, or Blackout text sections in the document using relevant tools.

- Add a date, initials, or even an image to the document if required.

- Use the Sticky note tool to make annotations on the form.

- Incorporate the Arrow and Line, or Draw tool to insert graphical components to your document.

To obtain a SC tax exemption certificate, you must complete the appropriate application with the SCDOR. This typically involves submitting specific documentation proving your eligibility for the exemption. Once approved, you'll receive the certificate, which you can present when making tax-exempt purchases.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.