Get Ca Ftb 588 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

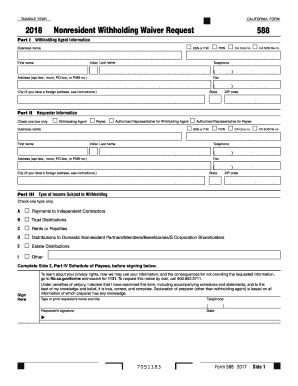

Tips on how to fill out, edit and sign CA FTB 588 online

How to fill out and sign CA FTB 588 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period commenced unexpectedly or perhaps you simply neglected it, it could likely cause issues for you. CA FTB 588 is not the simplest form, but there is no need for alarm under any circumstances.

Utilizing our robust solution, you will discover how to complete CA FTB 588 even in circumstances of significant time limitations. You merely need to adhere to these easy instructions:

With our comprehensive digital solution and its advantageous tools, submitting CA FTB 588 becomes more convenient. Don’t hesitate to give it a try and allocate more time to hobbies instead of document preparation.

Access the document with our sophisticated PDF editor.

Input the necessary details in CA FTB 588, utilizing the fillable fields.

Add images, marks, checks, and text boxes, if applicable.

Subsequent fields will be automatically filled after the initial entry.

If you encounter any challenges, employ the Wizard Tool. You will obtain some guidance for simpler submission.

Remember to include the date of submission.

Generate your unique signature once and place it in the designated areas.

Review the details you have entered. Rectify errors if necessary.

Hit Done to finalize modifications and choose your method of submission. You will have the option to use virtual fax, USPS, or email.

Additionally, you can download the document to print it later or upload it to cloud storage services such as Google Drive, Dropbox, etc.

How to modify Get CA FTB 588 2012: personalize forms online

Bid farewell to an outdated paper-based method of completing Get CA FTB 588 2012. Get the form filled out and certified in moments with our exceptional online editor.

Are you obligated to modify and complete Get CA FTB 588 2012? With a sophisticated editor like ours, you can accomplish this process in mere minutes without needing to print and scan documents repeatedly. We provide entirely editable and user-friendly form templates that will serve as a foundation and assist you in completing the required document template online.

All documents, by default, have fillable fields you can work on once you access the form. However, should you need to enhance the current content of the form or incorporate new content, you can select from a variety of customization and annotation features. Highlight, blackout, and comment on the text; add checkmarks, lines, text boxes, images, notes, and comments. Additionally, you can easily certify the form with a legally-recognized signature. The finished form can be shared with others, stored, imported into external applications, or converted into any other format.

You’ll never regret choosing our web-based tool to fill out Get CA FTB 588 2012 because it's:

Don't squander time filling out your Get CA FTB 588 2012 the traditional way - with pen and paper. Utilize our comprehensive solution instead. It provides you with a versatile suite of editing choices, built-in eSignature capabilities, and convenience. What sets it apart is the collaborative features - you can work together on documents with anyone, develop a well-organized document approval process from scratch, and much more. Try our online tool and get the greatest value for your investment!

- Simple to set up and operate, even for those who haven’t completed documents online before.

- Robust enough to meet various editing requirements and form types.

- Safe and secure, ensuring your editing experience is safeguarded every time.

- Compatible with different operating systems, facilitating easy completion of the form from any location.

- Able to generate forms based on pre-existing templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

In California, a fiduciary income tax return must be filed by a fiduciary managing an estate or trust. This return ensures that the income generated from the estate or trust is reported accurately to the state. If the estate or trust has taxable income, you'll use the CA FTB 588 to file the necessary information. Understanding these requirements helps you fulfill your obligations while efficiently managing the estate or trust.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.