Loading

Get Ca Ftb 590 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 590 online

This guide provides clear instructions for completing the CA FTB 590 withholding exemption certificate online. Whether you are a first-time user or someone needing a refresher, this comprehensive guide will assist you through each step.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the withholding agent's information at the top of the form, including their name.

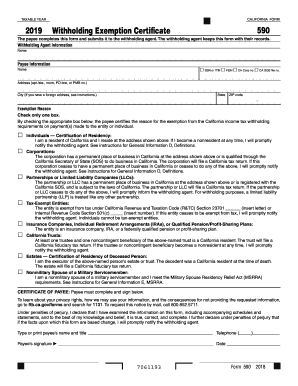

- Provide your personal details in the payee information section. Enter your name, select the appropriate identification number type (SSN, ITIN, FEIN, CA Corp no., or CA SOS file no.), and complete your address, city, state, and ZIP code.

- In the exemption reason section, check only one box that applies to your situation. Ensure you understand each option — individuals, corporations, partnerships, tax-exempt entities, and trusts — and select the appropriate one.

- Complete the certificate of payee section by typing or printing your name and title. Then, provide your telephone number.

- Sign the form in the designated area and enter the date of completion.

- Review all entered information for accuracy, make any necessary corrections, and ensure all required fields are completed.

- Finally, save your changes. You can choose to download, print, or share the form as needed.

Complete your CA FTB 590 form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When completing a California resale certificate, provide the required seller and purchaser information, including names and addresses. Indicate the type of item being purchased for resale and ensure that your seller's permit number is included. Accurate completion is essential for compliance, and understanding the implications related to CA FTB 590 can prevent tax complications.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.