Loading

Get Sc Dor St-8a 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR ST-8A online

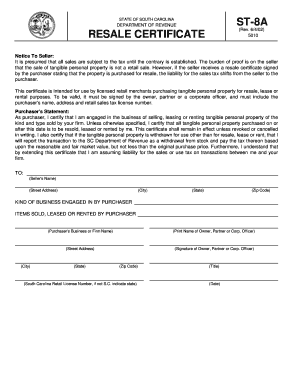

Filling out the SC DoR ST-8A form is essential for licensed retail merchants in South Carolina who wish to purchase tangible personal property for resale. This guide will help you understand each component of the form and provide clear instructions for completing it online.

Follow the steps to complete the SC DoR ST-8A form accurately.

- Click the ‘Get Form’ button to download the SC DoR ST-8A form and open it in your editor.

- Begin by entering the seller's information, including their name, street address, city, state, and zip code. This section establishes whom you are purchasing from.

- Next, provide your business information. Enter the name of your business or firm and your business address, including street address, city, state, and zip code.

- Identify the type of business you engage in by filling in the field for 'Kind of business engaged in by purchaser'. Clearly state what your business does.

- List the items that you sell, lease, or rent by filling in the section titled 'Items sold, leased or rented by purchaser.' Be specific about the products or services offered.

- Sign the form. The certificate must be signed by the owner, partner, or corporate officer. Print their name, title, and date of signing.

- Include your South Carolina retail license number in the designated field. Ensure you provide a valid number, as your resale certificate will not be accepted without one.

- Review the information you've entered to ensure accuracy and completeness. Once satisfied, you can proceed to save your unfinished work.

- Finalize your form by downloading, printing, or sharing it as required. Make sure to keep a copy for your records.

Complete your documents online quickly and efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Claiming a sales tax refund in South Carolina involves completing the appropriate form provided by the SC DoR. You will typically use the ST-8A form to document your purchases and request a refund. Make sure to include all supporting receipts and documents to facilitate a smoother refund process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.