Loading

Get Sc St-388 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC ST-388 online

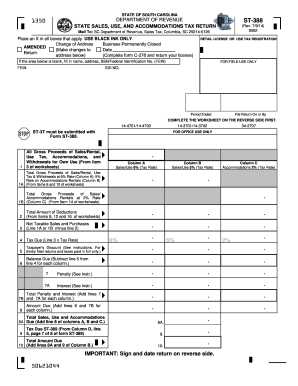

The SC ST-388 is an essential form for reporting sales, use, and accommodations tax in South Carolina. This guide provides clear, step-by-step instructions to help users effectively complete the form online.

Follow the steps to fill out the SC ST-388 accurately.

- Click 'Get Form' button to obtain the SC ST-388 and open it in your preferred editor.

- Begin by filling in your business information in the designated fields, including your name, address, and either your Social Security Number or Federal Identification Number (FEIN). Ensure that all provided information is accurate.

- Indicate the applicable boxes for any updates, such as a change of address or if the business has been permanently closed. Mark these options clearly with an 'X'.

- Complete the worksheet on the reverse side before entering figures into the main form. This worksheet helps gather necessary data on total gross proceeds, tax rates, and deductions.

- For total gross proceeds, sum all sales, rentals, use tax, accommodations, and withdrawals for own use. Record this amount in the respective columns based on their tax rates - 6%, 5%, or 2%.

- Calculate total deductions by itemizing the allowable deductions in the worksheet and transferring the totals back to line 2 for each applicable column on the main form.

- Determine the net taxable sales and purchases by subtracting total deductions from total gross proceeds. Enter these amounts in the appropriate line.

- Calculate the tax due by applying the respective tax rates to the net taxable amounts. Make sure to enter any taxpayer discounts if you qualify.

- Review all fields for accuracy, then sign and date the return on the reverse side, ensuring it is completed before the deadline.

- After filling out the form completely, save your changes in the editor, then proceed to download, print, or share the completed SC ST-388 as required.

Start completing your SC ST-388 online today for accurate and timely reporting!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out an Employee Withholding Exemption Certificate involves indicating your personal information, including your name, address, and Social Security number. You will also specify your filing status and claim the number of exemptions. Always review the form for accuracy before submission to your employer. For more clarity, USLegalForms has detailed instructions that can simplify this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.