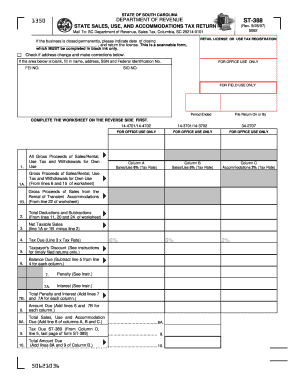

Get Sc St-388 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Exempts online

How to fill out and sign Allowable online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax blank completion can turn into a significant challenge and severe headache if no proper assistance provided. US Legal Forms is produced as an web-based option for SC ST-388 e-filing and provides many advantages for the taxpayers.

Utilize the tips about how to complete the SC ST-388:

-

Find the blank online inside the respective section or via the Search engine.

-

Press the orange button to open it and wait until it?s done.

-

Go through the template and pay attention to the guidelines. In case you have never completed the template before, stick to the line-to-line instructions.

-

Focus on the yellow fields. They are fillable and demand particular data to become inserted. If you are unclear what info to insert, see the instructions.

-

Always sign the SC ST-388. Utilize the built in instrument to generate the e-signature.

-

Click the date field to automatically put in the relevant date.

-

Re-read the template to check and change it prior to the submitting.

- Press the Done button in the upper menu if you have accomplished it.

-

Save, download or export the accomplished form.

Employ US Legal Forms to ensure secure and easy SC ST-388 filling out

How to edit Itemize: customize forms online

Have your stressless and paper-free way of editing Itemize. Use our reliable online option and save a lot of time.

Drafting every form, including Itemize, from scratch takes too much time, so having a tried-and-tested platform of pre-drafted document templates can do magic for your productivity.

But editing them can be struggle, especially when it comes to the files in PDF format. Luckily, our huge library includes a built-in editor that lets you quickly fill out and edit Itemize without leaving our website so that you don't need to lose hours executing your forms. Here's what to do with your form using our tools:

- Step 1. Locate the needed document on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Take advantage of professional modifying tools that let you insert, remove, annotate and highlight or blackout text.

- Step 4. Create and add a legally-binding signature to your form by using the sign option from the top toolbar.

- Step 5. If the document layout doesn’t look the way you want it, use the tools on the right to remove, include, and arrange pages.

- step 6. Insert fillable fields so other persons can be invited to fill out the document (if applicable).

- Step 7. Share or send out the form, print it out, or choose the format in which you’d like to get the file.

Whether you need to complete editable Itemize or any other document available in our catalog, you’re on the right track with our online document editor. It's easy and secure and doesn’t require you to have particular skills. Our web-based solution is set up to deal with practical everything you can imagine concerning document editing and execution.

No longer use traditional way of working with your documents. Choose a more efficient option to help you simplify your tasks and make them less dependent on paper.

To fill out an Employee Withholding Exemption Certificate, you need to give your personal information and indicate any exemptions you claim. Be precise in explaining the reason for your exemption status, and make sure to sign and date the certificate. Using SC ST-388 can help clarify any uncertainties during this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.