Loading

Get Sd Contractor's Excise Tax Return (formerly Rv-011)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SD Contractor's Excise Tax Return (formerly RV-011) online

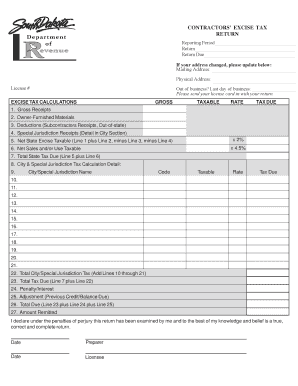

Filling out the SD Contractor's Excise Tax Return can seem challenging, but with this guide, you will navigate the process smoothly and efficiently. This step-by-step instruction will help you complete and submit the return correctly online.

Follow the steps to complete your return accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your reporting period and return due date in the relevant fields. Ensure that all dates are accurate to avoid future penalties.

- If your mailing or physical address has changed, enter the new information in the provided sections. Update both the mailing and physical addresses as needed.

- Input your license number in the designated field. If you are out of business, provide the last day of your business operations.

- Proceed to the excise tax calculations section. Input your gross receipts in Line 1. Then enter any owner-furnished materials in Line 2.

- List your deductions such as subcontractor receipts and out-of-state transactions in Line 3. Ensure that these figures are accurate to minimize tax liabilities.

- Calculate your special jurisdiction receipts in Line 4 and detail them in the city section if applicable.

- Determine your net state excise taxable amount by performing the calculation: Line 1 plus Line 2, minus Line 3, minus Line 4. Record this on Line 5.

- Next, input your net sales and/or use taxable amounts in Line 6. Then sum up Lines 5 and 6 to compute the total state tax due on Line 7.

- Complete the city and special jurisdiction tax calculation details in the subsequent lines, specifying the city or special jurisdiction name, code, and tax due as required.

- Add the total city/special jurisdiction tax from Lines 10 through 21 and record the result on Line 22.

- Calculate the overall tax due by totaling Line 7 and Line 22 to obtain the total tax due amount on Line 23.

- If applicable, include any penalties or interest on Line 24. Adjustments from previous credits or balances should be noted on Line 25.

- Calculate the total amount due by summing Lines 23, 24, and 25 and write the result on Line 26. Indicate the amount you are remitting on Line 27.

- Finally, review all entries for accuracy, and declare under penalties of perjury that the information is complete and truthful. Don't forget to provide your date and preparer's information.

- Once all fields are filled out correctly, you can save your changes. Download, print, or share the completed form as needed before submission.

Complete your SD Contractor's Excise Tax Return online today and take the first step toward fulfilling your tax obligations.

From a tax standpoint, royalties are generally reported to you on a form 1099- MISC at box 2 and are taxable as ordinary income. Interestingly, however, there's no one size Schedule fits all for royalties. ... Royalty income reported on a Schedule C or Schedule C-EZ is subject to self-employment income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.