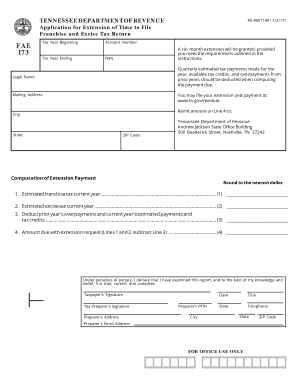

Get Tn Dor Fae 173 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign TN DoR FAE 173 online

How to fill out and sign TN DoR FAE 173 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax forms can turn into a significant obstacle and a considerable nuisance without appropriate assistance. US Legal Forms is designed as a digital solution for TN DoR FAE 173 electronic submission and provides numerous benefits for taxpayers.

Utilize the advice on completing the TN DoR FAE 173:

Click the Done button on the top menu once you have finished it. Save, download, or export the finalized form. Utilize US Legal Forms to guarantee secure and straightforward TN DoR FAE 173 completion.

- Acquire the form on the site in the designated section or through the search engine.

- Press the orange button to launch it and wait until it is finished.

- Examine the form and pay attention to the instructions. If this is your first time completing the document, follow the step-by-step directions.

- Concentrate on the highlighted sections. They are editable and require specific information to be filled in. If you are unclear about what to enter, refer to the instructions.

- Always sign the TN DoR FAE 173. Use the integrated tool to create your electronic signature.

- Select the date field to automatically insert the correct date.

- Review the form to revise and edit it prior to the electronic submission.

How to adjust Get TN DoR FAE 173 2017: personalize forms on the internet

Select a dependable document editing solution you can rely on. Amend, execute, and validate Get TN DoR FAE 173 2017 securely online.

Frequently, modifying documents, like Get TN DoR FAE 173 2017, can be difficult, particularly if you acquired them in a digital format but lack access to specific tools. Naturally, there are some alternatives to circumvent it, but you risk producing a document that fails to fulfill the submission criteria. Utilizing a printer and scanner is not a solution either, as it consumes both time and resources.

We provide a simpler and more efficient method of completing documents. A vast array of document templates that are straightforward to modify and validate, and make fillable for certain individuals. Our offering goes far beyond just a selection of templates. One of the greatest advantages of using our services is that you can edit Get TN DoR FAE 173 2017 directly on our site.

Since it’s a web-based option, it spares you from needing to download any software application. Moreover, not all corporate regulations allow you to install it on your work laptop. Here’s how you can easily and securely manage your paperwork with our platform.

Bid farewell to paper and other ineffective methods of managing your Get TN DoR FAE 173 2017 or other documents. Embrace our solution instead, which combines one of the most extensive libraries of editable forms with powerful document editing services. It’s simple and secure, and can save you significant time! Don’t just take our word for it, give it a try yourself!

- Hit the Get Form > you’ll be immediately taken to our editor.

- Once opened, you can initiate the editing procedure.

- Select checkmark or circle, line, arrow and cross and other options to annotate your form.

- Choose the date option to attach a specific date to your document.

- Insert text boxes, images, notes and more to enhance the content.

- Utilize the fillable fields option on the right to create fillable {fields}.

- Select Sign from the top toolbar to produce and form your legally-binding signature.

- Click DONE and save, print, and distribute or obtain the document.

To make a payment on your tntap account, log in to your account using your credentials. Once you are logged in, navigate to the payment section where you can choose your payment method—either by bank transfer or credit card. For any difficulties during this process, consider checking the TN DoR FAE 173 for guidance or using uslegalforms to streamline the payment process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.