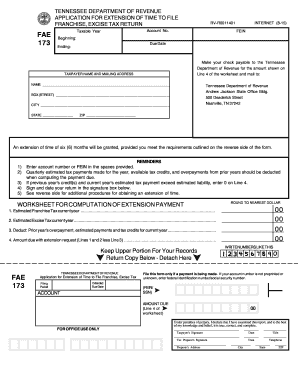

Get Tn Dor Fae 173 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign TN DoR FAE 173 online

How to fill out and sign TN DoR FAE 173 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can become a significant hurdle and major headache if appropriate help is not provided. US Legal Forms offers an online solution for TN DoR FAE 173 e-filing and comes with many benefits for taxpayers.

Follow the instructions on how to fill out the TN DoR FAE 173:

Click the Done button in the top menu once you have completed it. Save, download, or export the filled-out form. Utilize US Legal Forms to guarantee a secure and straightforward TN DoR FAE 173 completion.

- Locate the blank form on the website in the relevant section or through the search engine.

- Click the orange button to open it and wait for it to load.

- Examine the blank form and adhere to the guidelines. If you have never completed the form before, follow the step-by-step instructions.

- Focus on the highlighted fields. They are fillable and require specific information to be added. If you are unsure of what information to enter, refer to the instructions.

- Always sign the TN DoR FAE 173. Use the integrated tool to create your e-signature.

- Click on the date field to automatically add the correct date.

- Review the form again to edit and adjust it before submission.

How to modify Get TN DoR FAE 173 2015: personalize forms online

Simplify your document preparation procedure and tailor it to your requirements with just a few clicks. Complete and endorse Get TN DoR FAE 173 2015 using a thorough yet user-friendly online editor.

Drafting documents is often cumbersome, especially when it’s infrequent. It requires you to strictly comply with all formalities and accurately fill in every section with complete and precise information. Nonetheless, it frequently occurs that you need to adjust the file or add new sections to complete. If you want to enhance Get TN DoR FAE 173 2015 before submission, the best way to achieve this is by utilizing our all-inclusive yet straightforward online editing tools.

This versatile PDF editing tool allows you to promptly and effortlessly finalize legal documents from any device with internet access, carry out minor modifications to the template, and add extra fillable sections. The service allows you to select a specific area for each type of data, such as Name, Signature, Currency, and SSN, among others. You can set these as mandatory or conditional and designate who should fill each section by associating them with a specific recipient.

Our editor is a versatile, feature-rich online solution that can assist you in swiftly and efficiently tailoring Get TN DoR FAE 173 2015 along with other templates according to your specifications. Streamline document preparation and submission time and ensure your forms appear impeccable without any fuss.

- Access the necessary file from the directory.

- Complete the empty sections with Text and apply Check and Cross tools to the checkboxes.

- Utilize the toolbar on the right side to alter the form with additional fillable sections.

- Choose the fields based on the type of information you wish to be collected.

- Set these fields as mandatory, optional, or conditional, and arrange their sequence.

- Assign each field to a particular individual using the Add Signer feature.

- Confirm that you've implemented all necessary changes and click Done.

TN Form FAE 172 is a tax form related to the Franchise and Excise Tax in Tennessee. This form is typically used for requesting full year and part year status for excise tax purposes. Understanding when and how to use this form is crucial for meeting tax obligations. Again, US Legal Forms can offer you the necessary insights and forms to navigate these requirements effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.