Loading

Get Tn Dor Inc 250 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN DoR INC 250 online

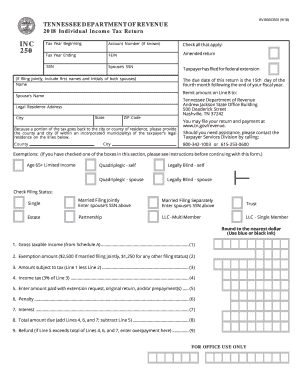

This guide provides comprehensive instructions for completing the Tennessee Department of Revenue's Individual Income Tax Return, known as the TN DoR INC 250, online. By following these steps, users can effectively navigate the form, ensuring accurate and timely submission.

Follow the steps to complete the TN DoR INC 250 online successfully.

- Press the ‘Get Form’ button to obtain the TN DoR INC 250 and open it in the online editor.

- Fill in the Tax Year Beginning and Tax Year Ending fields with the appropriate dates for your tax return.

- Provide your Account Number if you know it; otherwise, you may leave this blank.

- Indicate whether you are filing an Amended Return by checking the appropriate box if applicable.

- Input your Social Security Number (SSN) and, if applicable, your spouse’s SSN in the respective fields.

- Enter both your names as well as your spouse’s name, if filing jointly, including initials.

- Fill in your Legal Residence Address, including State, City, and ZIP Code.

- Provide the name of the County and City of your legal residence as requested.

- Check the applicable exemptions based on your age or disability status.

- Select your Filing Status by checking the appropriate box: Single, Married Filing Jointly (include spouse's SSN), Married Filing Separately (include spouse's SSN), Trust, Estate, Partnership, LLC - Multi Member, or LLC - Single Member.

- Transfer your Gross Taxable Income from Schedule A on Line 1.

- Enter the Exemption Amount on Line 2 based on your filing status.

- Calculate Amount Subject to Tax by subtracting Line 2 from Line 1 and enter this on Line 3.

- Calculate your Income Tax by multiplying the amount on Line 3 by the tax rate of 3% and enter the figure on Line 4.

- Enter any amount previously paid with an extension request or other payments on Line 5.

- Calculate the Penalty for late filing based on the guidelines and enter it on Line 6.

- Calculate Interest due on any unpaid tax amount as of the due date, according to state regulations, and enter it on Line 7.

- Sum Lines 4, 6, and 7, and subtract Line 5 to determine the Total Amount Due on Line 8.

- If applicable, enter the Refund amount on Line 9, indicating any overpayment.

- Review your completed form for accuracy, then save your changes, download it, or print it for submission.

Complete your TN DoR INC 250 online to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Receiving a letter from the TN Department of Revenue often indicates that there are updates or actions required regarding your business taxes. This could include notices about outstanding taxes or compliance reminders related to the TN DoR INC 250. It’s wise to respond promptly to avoid further issues.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.