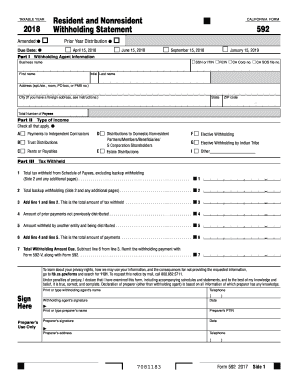

Get Ca Ftb 592 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 592 online

How to fill out and sign CA FTB 592 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax season commenced unexpectedly or you simply overlooked it, it could likely lead to issues for you.

CA FTB 592 is not the simplest form, but there is no need for alarm in any situation.

With this comprehensive digital tool and its supportive features, filling out CA FTB 592 becomes much easier. Don’t hesitate to use it and allocate more time to your hobbies and interests instead of document preparation.

- Access the document using our sophisticated PDF editor.

- Complete the necessary details in CA FTB 592, utilizing the fillable fields.

- Add images, crosses, check marks, and text boxes, if desired.

- Repeated information will be automatically populated after the initial entry.

- If there are any confusions, activate the Wizard Tool. You'll receive helpful hints for simpler completion.

- Always remember to include the application date.

- Create your distinct signature once and place it in the required areas.

- Review the information you have entered. Rectify errors if necessary.

- Click Done to complete modifications and select your method of submission. You will have the option to utilize digital fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to cloud storage such as Dropbox, OneDrive, etc.

How to Alter Get CA FTB 592 2018: Personalize forms online

Locate the appropriate Get CA FTB 592 2018 template and change it on the fly.

Enhance your documentation with an intelligent form editing utility for web-based forms.

Your everyday operations with documents and forms can be more efficient when you have everything you need in one location. For example, you can search for, acquire, and alter Get CA FTB 592 2018 in just a single browser tab. If you require a specific Get CA FTB 592 2018, you can quickly locate it using the advanced search engine and access it immediately.

There is no need to download it or seek out a third-party editor to alter it and input your details. All the tools for productive work come in just one comprehensive solution.

After that, you can send or print your document if needed.

- This editing utility enables you to personalize, complete, and sign your Get CA FTB 592 2018 form directly on the spot.

- As soon as you encounter a suitable template, click on it to enter the editing mode.

- Once the form is opened in the editor, all the essential tools are readily available.

- It is straightforward to fill in the designated fields and remove them if necessary with aid from a simple yet multifunctional toolbar.

- Implement all the changes instantly, and sign the form without leaving the tab by merely clicking the signature field.

Yes, CA 592 can be filed electronically through the California Franchise Tax Board's online portal. Filing electronically streamlines the submission process, allowing for faster processing of your tax documents. Utilizing the electronic filing option for CA FTB 592 not only enhances convenience but also helps ensure accuracy in your submissions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.