Loading

Get Ca Ftb 592 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 592 online

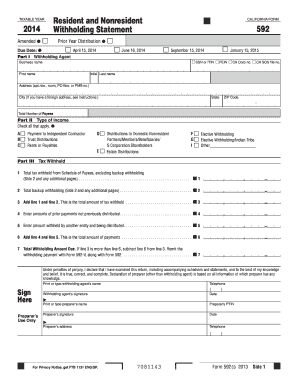

Filling out the CA FTB 592 online is essential for reporting tax withheld on California source payments. This guide will provide you with clear, step-by-step instructions to ensure accurate and efficient completion of the form.

Follow the steps to complete the CA FTB 592 online.

- Press the ‘Get Form’ button to access the CA FTB 592 form and open it in the digital editor.

- Enter the required information in Part I, which is the Withholding Agent section. Provide your business name, first and last name, address, and select the appropriate identification number (SSN, ITIN, FEIN). Also, input the total number of payees.

- Move to Part II, Type of Income. Check all applicable boxes to indicate the type of income from which tax was withheld, such as payments to independent contractors, rents, or distributions.

- Proceed to Part III, Tax Withheld. Start by entering the total tax withheld from the Schedule of Payees in line 1, excluding any backup withholding. Then, enter the total backup withholding in line 2.

- Add the total from lines 1 and 2 in line 3 to find the total amount of tax withheld. Continue with line 4 by entering any prior payments not previously distributed.

- In line 5, report any amounts withheld by another entity that are being distributed. Line 6 should represent the total amount of payments.

- Lastly, calculate the Total Withholding Amount Due in line 7. If the total from line 3 is greater than line 6, subtract line 6 from line 3. If applicable, attach the appropriate payment along with Form 592-V.

- Complete the Schedule of Payees on Side 2, ensuring all information is filled accurately for each payee. Avoid leaving any payee boxes blank unless at the end of the record.

- After reviewing all information, you can save your changes, download, print, or share the completed form as needed.

Start completing your CA FTB 592 online today to ensure timely and accurate reporting!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Individuals or businesses making payments subject to withholding for non-residents must fill out California form 590. This form helps clarify the withholding responsibilities of the payer. Utilizing USLegalForms can guide you through this process, reducing errors and ensuring compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.