Loading

Get Tx 05-359 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 05-359 online

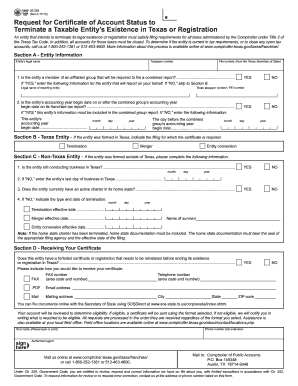

The TX 05-359 form is a request for a certificate of account status to terminate a taxable entity’s existence or registration in Texas. This guide provides a clear and user-friendly approach to filling out the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the TX 05-359 form effectively.

- Press the ‘Get Form’ button to obtain the TX 05-359 form and open it for editing.

- In Section A, provide the entity’s legal name, taxpayer number, and file number from the Texas Secretary of State.

- Answer the first question regarding whether the entity is a member of an affiliated group that needs to file a combined report. If ‘YES,’ include the reporting entity's legal name and taxpayer number. If ‘NO,’ proceed to Section B.

- Indicate the accounting year begin date, and answer the subsequent question regarding inclusion in the combined group report based on the accounting year timeline.

- For Section B, if the entity was formed in Texas, specify the filing requiring the certificate. For Section C, if the entity was formed outside Texas, answer the questions about conducting business in Texas and provide the last business day if applicable.

- In Section D, ascertain if the entity has a forfeited certificate or registration needing reinstatement. Indicate the preferred method of receiving the certificate — via fax, PDF, or mail — and provide necessary contact details.

- After completing all sections, review the information for accuracy. You can then save changes, download a copy for records, print the form, or share it as needed.

Complete your documents online for a seamless filing experience.

To file an amended Texas sales tax return, you need to fill out Form 01-300, ensuring it is clearly marked as 'amended.' Include accurate figures to reflect any changes in your previous filing. It can be submitted online or by mail to the appropriate office. For a smoother experience with your TX 05-359 amendments, using US Legal Forms can be beneficial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.