Get Tx Comptroller 50-144 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

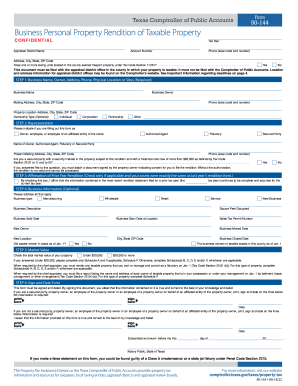

This guide provides clear instructions on how to complete the TX Comptroller 50-144 form online, which is essential for rendering business personal property for taxation. Whether you are a business owner or an authorized representative, this step-by-step approach will ensure that you correctly fill out each section of the form.

Follow the steps to complete the TX Comptroller 50-144 form efficiently.

- Click the ‘Get Form’ button to retrieve the form and open it in your editor of choice.

- Enter the tax year in the designated field at the top of the form.

- Fill out the appraisal district name, account number, and contact phone number as required.

- Provide your address, including city, state, and ZIP code.

- Indicate whether any taxing units located in the county exempt freeport property under Tax Code Section 11.251 by selecting 'Yes' or 'No'.

- In 'Step 1', complete the business name, owner, mailing address, and phone number fields.

- List the physical location or situs of the business property, including the address and ZIP code.

- Select the ownership type, if applicable (Individual, Corporation, Partnership, or Other).

- In 'Step 2', indicate your representation status by selecting one of the provided options (Owner, Authorized Agent, Fiduciary, or Secured Party) and fill in the relevant contact details.

- Complete 'Step 3' by checking the box if you affirm that your assets are the same as last year's rendition.

- Proceed to 'Step 4' to describe business type and other relevant information. This section is optional.

- In 'Step 5', check the total market value of your property by choosing either 'Under $20,000' or '$20,000 or more'. Depending on your selection, complete the corresponding schedules.

- Finally, in 'Step 6', sign and date the form. Ensure that it is signed appropriately based on your designation (secured party, owner, etc.).

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed.

Start filling out the TX Comptroller 50-144 form online today!

Get form

Yes, turning 65 in Texas can lower your property taxes through exemptions designed for seniors. The TX Comptroller 50-144 reflects this eligibility, allowing seniors to claim significant tax advantages. This opportunity often leads to reduced financial burdens, enabling comfortable living for older Texans. You can find comprehensive support and guidance on applying through uslegalforms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.