Get Tx Comptroller 50-144 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

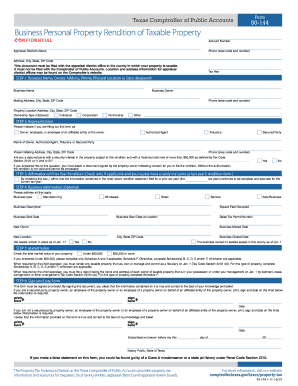

This guide provides clear and detailed instructions for filling out the TX Comptroller Form 50-144, which is used for rendering business personal property for tax purposes. Following these steps will help ensure you complete the form correctly and submit it efficiently.

Follow the steps to complete your TX Comptroller Form 50-144 online.

- Click the ‘Get Form’ button to obtain the form and open it in the appropriate editing tool.

- Enter the account number in the designated field. This is important for identifying your property uniquely within the appraisal district.

- Input the appraisal district's name and phone number in the specified fields.

- Fill in your property's address, including the city, state, and ZIP code. This is where the property is located for tax purposes.

- Indicate the tax year for which you are filing the rendition. This ensures your submission corresponds to the correct tax period.

- Provide your business name and the owner's name in the respective fields. Include the mailing address, city, state, and ZIP code. Ensure your contact number is accurate.

- Specify the property location's address along with its ownership type, selecting from individual, corporation, partnership, or others.

- Indicate your representation role in filling out the form, choosing from owner, authorized agent, fiduciary, or secured party.

- Attach any required documentation if you are a secured party with a security interest. This includes a document signed by the property owner.

- If your assets from the previous year remain unchanged, check the affirmation box and provide the prior tax year.

- Complete the optional business information section; this includes the type of business and specific operational details.

- State the total market value of your property to determine the applicable schedules you need to complete.

- Sign and date the form in the appropriate area. This confirms the accuracy of the submitted information.

- Once completed, save the changes you made. You can also download, print, or share the filled form as needed.

Complete your TX Comptroller Form 50-144 online today for an efficient filing experience.

Get form

In Texas, certain exemptions from property taxes apply after the death of a property owner. Surviving spouses and individuals with disabilities may qualify for continued tax exemptions. Familiarize yourself with the TX Comptroller 50-144 regulations to understand the criteria and process for claiming these benefits. Navigating these exemptions can provide relief during a challenging time.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.