Loading

Get Tx Comptroller 50-144 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

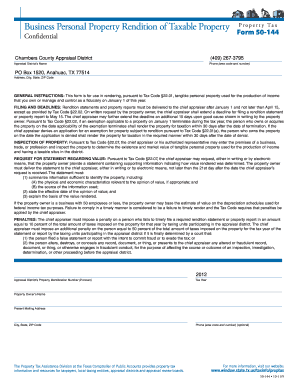

Filling out the TX Comptroller Form 50-144 is crucial for reporting business personal property used for income production. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the appraisal district’s name, which you can find on the form. Input the property tax year as indicated.

- Provide the property owner's name and present mailing address, ensuring that it reflects current information.

- Indicate your role by selecting whether you are filling out the form as a manager, authorized agent, or in a fiduciary capacity. If applicable, enter the name of the relevant individual.

- Check the box to affirm that the information in your recent rendition statement is accurate or proceed to complete the necessary schedules depending on the total market value of your property.

- Fill out Schedule A if the property is valued under $20,000, listing all taxable personal property, along with their descriptions and applicable addresses.

- If the property is valued at $20,000 or more, complete Schedule B and/or C, providing detailed information about each item of personal property and its estimated market value.

- Complete Schedule D if you manage property under bailment, lease, or consignment, including the property owner's name and address.

- Finally, ensure that the form is signed and dated. If you are an employee representing the property owner, complete the affirmation section.

- Review the entire document for accuracy. Save any changes, download a copy for your records, and print or share the form as needed.

Complete your TX Comptroller 50-144 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, the Texas homestead exemption is often very beneficial for homeowners. It can lower your property tax bill by reducing the assessed value of your home. Many Texans find this exemption valuable in maintaining affordable housing costs. For more details, consult the TX Comptroller 50-144 to learn how it can impact your property taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.