Get Tx Comptroller 50-246 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-246 online

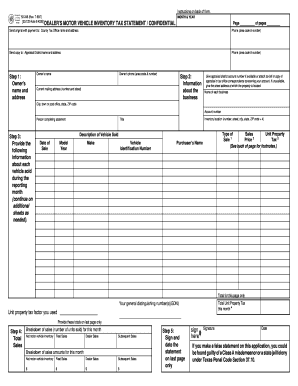

The TX Comptroller 50-246 form is essential for reporting motor vehicle inventory taxes in Texas. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently, enhancing your compliance with local tax requirements.

Follow the steps to successfully fill out the TX Comptroller 50-246 online.

- Click the ‘Get Form’ button to access the TX Comptroller 50-246 form and open it for editing.

- In the first section, input the owner's name and address, including the owner's phone number. Ensure accuracy in this essential information.

- Provide details about the business. Include the current mailing address, the appraisal district account number if available, or attach relevant tax documentation. Record the business's name and location.

- List each vehicle sold during the reporting month in the designated area. Include all required details such as inventory location, title, type of sale, sales price, and vehicle identification number. Note any additional sheets needed for listing all vehicles.

- Calculate and report the total sales for the month, breaking down the number of units sold in each category, ensuring the figures align with the vehicle sales information.

- Sign and date the statement at the end of the form. Verify that all information is accurate before submission.

- Once completed, you can save your changes, download your form, print it, or share it as needed.

Complete your TX Comptroller 50-246 form online today to stay compliant with Texas tax regulations.

Get form

Related links form

To obtain your Texas Comptroller XT number, visit the Texas Comptroller's website and navigate to the appropriate section for application. You will need to complete the necessary forms, providing your TX Comptroller 50-246 details. Once submitted, the office will process your request, and you will receive your XT number via the method you selected. This number is essential for various compliance tasks in Texas.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.