Get Tx Hotel Occupancy Tax - City Of Weslaco 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

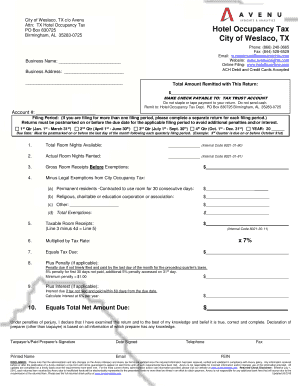

Tips on how to fill out, edit and sign TX Hotel Occupancy Tax - City of Weslaco online

How to fill out and sign TX Hotel Occupancy Tax - City of Weslaco online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing tax forms can become a significant issue and a real challenge without suitable help provided.

US Legal Forms was established as an online solution for TX Hotel Occupancy Tax - City of Weslaco e-filing and offers several benefits for taxpayers.

Press the Done button on the top menu once you have finished. Save, download, or export the completed form. Utilize US Legal Forms to ensure safe and easy completion of the TX Hotel Occupancy Tax - City of Weslaco.

- Access the blank form online in the appropriate section or through the search engine.

- Click the orange button to open it and wait until it’s ready.

- Examine the blank and pay close attention to the instructions. If you haven't filled out the template before, adhere to the step-by-step instructions.

- Pay attention to the yellow fields. They are fillable and require specific information to be entered. If you're uncertain about what data to enter, refer to the instructions.

- Always sign the TX Hotel Occupancy Tax - City of Weslaco. Utilize the built-in tool to create your e-signature.

- Select the date field to automatically input the correct date.

- Review the sample to verify and amend it before submission.

How to Revise Get TX Hotel Occupancy Tax - City of Weslaco 2018: Personalize forms online

Locate the right Get TX Hotel Occupancy Tax - City of Weslaco 2018 template and adjust it instantly.

Streamline your documentation with an intelligent form editing solution for online submissions.

Your daily routine with documents and forms can be more efficient when you have everything necessary consolidated in one location. For example, you can discover, obtain, and adjust Get TX Hotel Occupancy Tax - City of Weslaco 2018 in a single browser tab. If you're seeking a specific Get TX Hotel Occupancy Tax - City of Weslaco 2018, you can effortlessly locate it using the intelligent search tool and access it right away.

You don’t need to download it or search for an external editor to adjust it and insert your information. All the instruments for productive work are packaged together.

After that, you can send or print your document if required.

- This editing tool allows you to modify, complete, and sign your Get TX Hotel Occupancy Tax - City of Weslaco 2018 form instantly.

- Once you find a suitable template, click on it to enter the editing mode.

- When you load the form in the editor, you have all the required tools at your disposal.

- It is simple to fill in the designated fields and remove them if necessary using an uncomplicated yet versatile toolbar.

- Make all modifications at once and sign the form without leaving the tab by merely clicking the signature box.

Generally, hotel occupancy tax is not deductible for most travelers. Only business-related stays may allow deductions for these taxes on tax returns. Therefore, it's important to differentiate between personal and business travel when considering deductions. If you're unsure, resources like uslegalforms can guide you through understanding the tax implications related to the TX Hotel Occupancy Tax - City of Weslaco.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.