Get Ut Tc-65 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-65 online

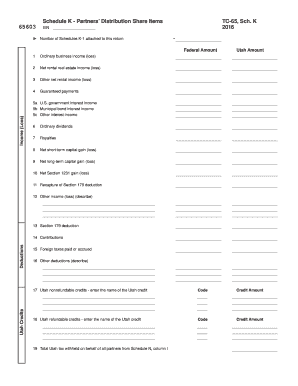

Filling out the UT TC-65 form online is an essential step for partnerships in Utah to report income, deductions, and credits. This guide provides a comprehensive overview of the form's components and offers step-by-step instructions to assist users in successfully completing the form.

Follow the steps to complete the UT TC-65 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering the partnership information, including the Employer Identification Number (EIN), partnership name, address, city, state, and ZIP code.

- Proceed to the income section where you will need to input ordinary business income or loss, net rental real estate income or loss, other rental income or loss, and guaranteed payments.

- Fill in the amounts for all applicable income categories including interest income, dividends, royalties, and capital gains or losses. Make sure to describe any other income or loss in the fields provided.

- Next, you will enter any deductions and credits associated with the partnership. This includes contributions made, foreign taxes paid, and any other deductions you need to specify.

- Indicate the nonrefundable and refundable credits by entering the appropriate credit names and amounts in the designated fields.

- Review all entered information for accuracy, ensuring that amounts are filled out correctly and all required sections are completed.

- Finally, once you are satisfied with the information, you can save your changes, download the completed form, print it, or share it as needed.

Complete your documents online today to ensure accurate reporting and compliance.

Get form

For most taxpayers, it is not necessary to send a copy of your federal return when filing your Utah state return. However, specific circumstances might require additional documentation, especially if you are submitting form UT TC-65. It’s always a good practice to check the instructions provided by the Utah State Tax Commission or consult a tax professional for the most accurate guidance. This ensures that you complete your state return correctly and meet all requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.