Loading

Get Va 760-adj 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 760-ADJ online

Filling out the VA 760-ADJ form is a crucial step in managing your tax responsibilities in Virginia. This guide will provide you with clear and actionable steps to help you complete the form accurately and efficiently online.

Follow the steps to accurately complete your VA 760-ADJ online.

- Locate and use the ‘Get Form’ button to access the VA 760-ADJ form and open it in your preferred online editing tool.

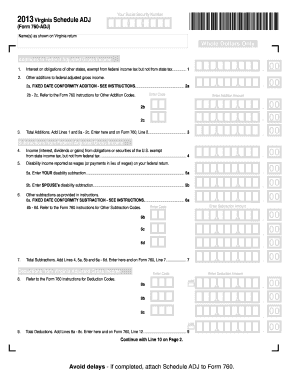

- Begin by entering your Social Security number at the top of the form. Ensure that it is correctly displayed as this information is critical for identifying your tax record.

- In the section labeled 'Name(s) as shown on Virginia return,' fill in the names of all individuals listed on your Virginia tax return.

- Proceed to the 'Additions to Federal Adjusted Gross Income' section. Start with Line 1, where you will enter any interest on obligations from other states that are exempt from federal income tax.

- For Lines 2a to 2c, you may need to refer to Form 760 instructions for specific codes related to other additions. Enter these codes and the corresponding addition amounts as applicable.

- Continue to the 'Subtractions from Federal Adjusted Gross Income' section. Fill in Line 4 with income from U.S. obligations that are exempt from state tax.

- For the disability income, complete Lines 5a and 5b, inputting the amounts reported on your federal return if applicable.

- Complete the 'Deductions from Virginia Adjusted Gross Income' section, including the relevant codes and amounts on Lines 8a to 8c.

- On Page 2 of the form, report your Virginia Adjusted Gross Income (VAGI) and the total number of exemptions in the specified areas.

- Finalize your form by reviewing all entries for accuracy. Once completed, you can save changes, download, print, or share the form as needed.

Complete your VA 760-ADJ online today to ensure accurate tax filing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filing your Virginia state taxes, you typically need Form 760 or 760PY for part-year residents, along with any supporting forms relevant to your financial situation. If you are amending a previous return, you will also require the VA 760-ADJ form. To ensure accuracy and compliance, consider checking the requirements outlined on the Virginia Department of Taxation's website or using services from US Legal Forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.