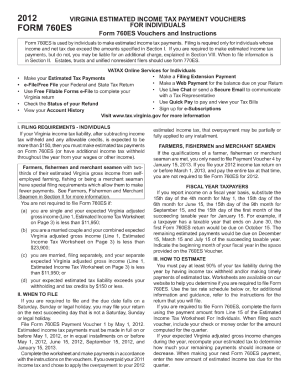

Get Va Dot 760es 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign VA DoT 760ES online

How to fill out and sign VA DoT 760ES online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The completion of tax forms can turn into a major hindrance and a serious nuisance if no adequate help is available.

US Legal Forms serves as an online solution for VA DoT 760ES electronic filing and presents numerous benefits for taxpayers.

Press the Done button in the upper menu once you have finished it. Save, download, or export the completed form. Utilize US Legal Forms to ensure secure and effortless VA DoT 760ES completion.

- Locate the template on the site within the designated category or through the search function.

- Press the orange button to launch it and wait for it to finish.

- Examine the form and pay attention to the instructions. If you have not filled out the form previously, adhere to the step-by-step guidance.

- Concentrate on the highlighted fields. These are editable and require specific information to be entered. If unsure what to include, refer to the instructions.

- Always sign the VA DoT 760ES. Utilize the integrated tool to create your electronic signature.

- Select the date field to automatically insert the correct date.

- Revisit the form to review and modify it prior to electronic filing.

How to Modify Get VA DoT 760ES 2012: Personalize Forms Online

Utilize our all-inclusive online document editor while preparing your documentation.

Complete the Get VA DoT 760ES 2012 by highlighting the most important details and effortlessly making any other necessary modifications to its contents.

Creating documents digitally saves time and offers the ability to alter the template according to your preferences. If you’re preparing the Get VA DoT 760ES 2012, think about filling it out using our thorough online editing tools. Whether you make a mistake or input the required information in the incorrect section, you can promptly amend the document without having to restart it from scratch as you would with manual entry. Furthermore, you can indicate the essential information in your documentation by emphasizing specific parts of the content with colors, underlining them, or encircling them.

Our comprehensive online services are the most efficient means to complete and modify the Get VA DoT 760ES 2012 tailored to your necessities. Utilize it to handle personal or professional documents from anywhere. Access it in a browser, make any alterations to your documents, and revisit them at any future time - they will all be securely stored in the cloud.

- Access the file in the editor.

- Enter the necessary information into the blank fields using Text, Check, and Cross instruments.

- Follow the document navigation to avoid missing any required fields in the template.

- Encircle some of the key information and include a URL to it if needed.

- Employ the Highlight or Line tools to emphasize the most critical facts.

- Select colors and thickness for these lines to ensure your form appears professional.

- Remove or obscure the details you do not want to be visible to others.

- Replace sections of text that contain errors and input the information you require.

- Complete editing with the Done option once you confirm everything is accurate in the document.

In your penalty abatement appeal request, include a clear explanation of your situation that led to the missed deadline or payment, along with supporting documentation. Evidence such as medical records, correspondence, or other relevant papers can strengthen your case. When referencing the VA DoT 760ES, clarity and comprehensiveness are key to a successful appeal.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.