Loading

Get Va Dot St-13a 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT ST-13A online

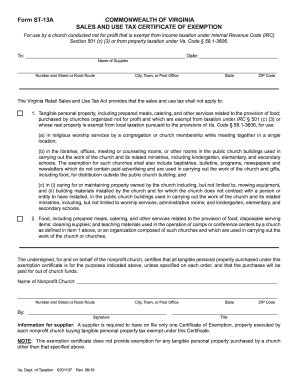

This guide provides a step-by-step process for completing the VA DoT ST-13A sales and use tax certificate of exemption form online. It aims to assist users, particularly nonprofit churches, in accurately filling out the necessary fields to ensure compliance with Virginia tax regulations.

Follow the steps to complete your exemption certificate.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the supplier in the designated field at the top of the form.

- Fill in the complete address details of the supplier, including the number and street or rural route, city, state, and ZIP code.

- In the next section, confirm the exemption details by providing the name of the nonprofit church and its complete address.

- Sign the form in the 'By' section, including the name of the individual signing and their title.

- Review all entered information for accuracy and completeness.

- Once confirmed, save your changes, download, print, or share the form as necessary.

Complete your documents online to ensure you meet all necessary tax exemption requirements.

Related links form

The income level exempt from taxes in Virginia depends on multiple factors such as filing status and personal exemptions. Generally, lower income levels may qualify for tax exemptions, thereby reducing taxable income. For more precise information, refer to the VA DoT ST-13A and consider discussing your case with a tax professional.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.