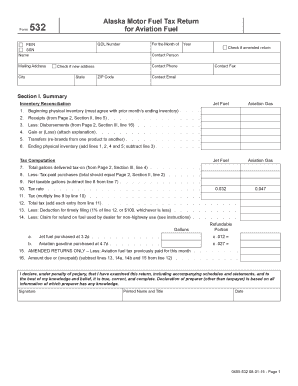

Get Ak Dor 532 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AK DoR 532 online

How to fill out and sign AK DoR 532 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period started unexpectedly or you merely overlooked it, it might lead to complications for you. AK DoR 532 isn't the simplest one, but you shouldn't have any reason for concern under any circumstances.

Utilizing our user-friendly service, you will discover how to complete AK DoR 532 in situations with significant time constraints. All you need to do is adhere to these straightforward guidelines:

With our all-inclusive digital service and its beneficial tools, completing AK DoR 532 becomes much simpler. Don't hesitate to utilize it and allocate more time for leisure activities instead of handling paperwork.

- Access the document using our specialized PDF editor.

- Input the necessary information in AK DoR 532, employing the fillable sections.

- Insert images, checkmarks, and text boxes, if required.

- Repeated information will be inserted automatically after the initial entry.

- If you encounter any confusion, enable the Wizard Tool. You will receive helpful hints for easier submission.

- Always remember to include the application date.

- Create your distinctive electronic signature once and place it in the designated areas.

- Review the information you have entered. Fix errors if necessary.

- Click Done to finish editing and choose your preferred method of submission. You will have the option to use virtual fax, USPS, or email.

- You can also download the document for later printing or upload it to cloud storage.

How to modify Get AK DoR 532 2015: personalize forms online

Explore a comprehensive service to manage all your documentation seamlessly. Locate, modify, and finalize your Get AK DoR 532 2015 within a single platform using advanced tools.

The era when individuals had to print forms or write them out by hand is past. Nowadays, finding and filling out any form, like Get AK DoR 532 2015, merely requires opening one browser tab. Here, you will discover the Get AK DoR 532 2015 form and modify it in any way you require, from inputting text directly in the document to sketching it on a digital sticky note and attaching it to the file. Uncover tools that will enhance your documentation process without added hassle.

Simply click the Get form button to prepare your Get AK DoR 532 2015 documentation swiftly and start modifying it immediately. In the editing mode, you can effortlessly fill out the template with your information for submission. Just click on the field you wish to alter and enter the details right away. The editor's interface does not necessitate any specialized skills to operate. Once you have completed the edits, verify the accuracy of the information once more and sign the document. Click on the signature field and follow the prompts to electronically sign the form in no time.

Utilize additional tools to modify your form:

Creating Get AK DoR 532 2015 forms will never be challenging again if you know where to locate the appropriate template and prepare it with ease. Feel free to give it a try.

- Employ Cross, Check, or Circle tools to identify the document's data.

- Insert text or fillable text fields using text customization tools.

- Remove, Highlight, or Blackout text sections in the document with the appropriate tools.

- Add a date, initials, or even an image to the document if required.

- Take advantage of the Sticky note tool to comment on the form.

- Use the Arrow and Line, or Draw tool to incorporate visual elements into your file.

Related links form

In TurboTax, form 5329 is an integral tool that helps you report and rectify excess contributions to your retirement accounts. The software streamlines the filing process, guiding you through each section to ensure you meet IRS requirements. By using TurboTax for form 5329, you can simplify the tax preparation process while minimizing errors and potential penalties.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.