Loading

Get Va Dot St-13a 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT ST-13A online

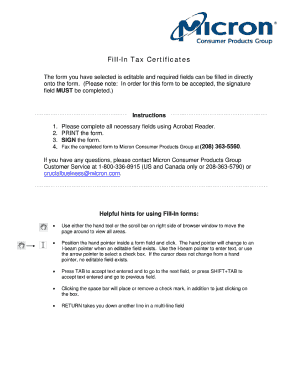

Filling out the VA DoT ST-13A form, also known as the sales and use tax certificate of exemption, is a straightforward process. This guide is designed to support users in efficiently completing the form online with confidence and accuracy.

Follow the steps to fill out the VA DoT ST-13A form online.

- Click the ‘Get Form’ button to access the VA DoT ST-13A form and open it in your preferred editor.

- Begin by entering the name of the dealer you are purchasing from in the designated field.

- Input the complete address of the dealer, including the number, street, city, state, and ZIP code.

- In the section that specifies the purpose of the exemption, check the box that applies to your purchase. Ensure that your selection aligns with the description provided.

- Fill in the name of your nonprofit church in the corresponding field, followed by the church's complete address.

- Sign the form by typing your name in the authorized representative section and indicate your title.

- Before finalizing, review all entered information for accuracy.

- Once satisfied, save your changes, and proceed to print the completed form.

- Hand sign the printed form in the designated signature field.

- Fax the signed document to Micron Consumer Products Group at the appropriate number. Keep the confirmation for your records.

Complete the VA DoT ST-13A form easily online and ensure your church's tax exemption benefits today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Qualifying for farm property tax exemption in Virginia involves meeting certain agricultural criteria, including the use of your land for farming. You will need to complete the VA DoT ST-13A form to establish your eligibility. Providing accurate and detailed information about your farming activities will significantly enhance your chances of approval.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.