Loading

Get Vt Dot S-3c 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT DoT S-3C online

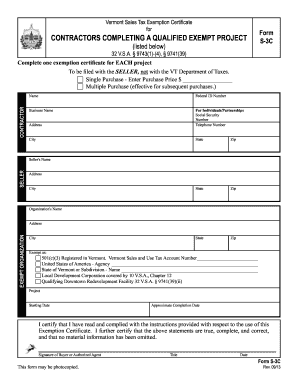

The Vermont Sales Tax Exemption Certificate for Contractors, known as Form S-3C, is essential for contractors involved in qualifying exempt projects. This guide provides clear instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the VT DoT S-3C online

- Press the 'Get Form' button to access the VT DoT S-3C form and open it for editing.

- In the 'Contractor' section, enter the required information including your name, Federal ID number, business name, address, city, state, and zip code. If you are an individual or partnership, provide your Social Security number and telephone number.

- In the 'Seller' section, input the seller's name, address, city, state, and zip code. This section identifies the seller from whom the materials will be purchased.

- Complete the 'Exempt Organization' section by providing the organization's name, address, city, state, and zip code. Select the exemption type that applies, such as 501(c)(3) or State of Vermont agency.

- Fill in the project details including the starting date and approximate completion date, which helps to specify the timeframe of the exempt project.

- Certify the accuracy of the information by signing the form in the designated area. Include your title and the date to validate the certificate.

- After completing all sections of the form, you can save your changes, download a copy of the completed form, print it, or share it as necessary.

Complete and submit your VT DoT S-3C form online to secure your sales tax exemption for qualified projects.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

VT sales tax is a tax imposed on the sale of goods and services in Vermont, currently set at a base rate of 6%. Understanding this tax is essential for residents and businesses alike, especially when filling out forms such as the VT DoT S-3C. Proper knowledge of VT sales tax rules ensures compliance and can help you manage your financial responsibilities effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.