Get Vt Form Hs-122 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Form HS-122 online

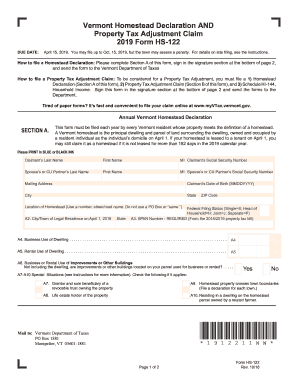

The VT Form HS-122 is essential for Vermont residents looking to declare their homestead status and apply for a property tax adjustment. This guide provides a step-by-step approach to completing the form online, ensuring that users can easily navigate the process and meet all necessary requirements.

Follow the steps to complete the VT Form HS-122 seamlessly.

- Use the 'Get Form' button to access the VT Form HS-122, opening it in an online editor.

- Begin with Section A, which requires you to fill in your last name, first name, middle initial, and social security number. Additionally, provide the same information for your spouse or civil union partner, if applicable.

- Enter your mailing address and date of birth. Ensure that you do not use a P.O. Box and provide the location of your homestead using the street address.

- Indicate your city/town of legal residence as of April 1, as well as your state and federal filing status (single, head of household, joint, or separate).

- Locate the SPAN number required from your property tax bill, and fill it in the designated field.

- Complete questions regarding the business or rental use of your dwelling by providing the percentage of the dwelling used for these purposes.

- Respond to the special situations in Section A by checking 'Yes' or 'No' as appropriate to confirm if any apply to you.

- Proceed to Section B to complete the property tax adjustment claim. Answer the eligibility questions regarding your domicile status and dependency for the calendar year.

- Enter the housesite value and taxes associated with education and municipality as found on your property tax bill, rounding to the nearest dollar.

- Calculate and fill out your household income as requested, ensuring to attach Schedule HI-144.

- After completing all sections, review your entries for accuracy. Sign the form at the bottom of page 2, including the date and contact number.

- Once finished, you can save changes, download the form for your records, print a hard copy, or share it as needed.

Complete your VT Form HS-122 online today for a convenient filing experience.

Get form

Related links form

Vermont property taxes are high because local governments rely on them to fund essential services, including public education and emergency services. High property values in certain areas can also contribute to increased tax assessments. Residents can benefit from completing VT Form HS-122 to claim credits and alleviate some tax burdens. Being proactive can help you manage your finances better.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.