Get Wi A-771 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

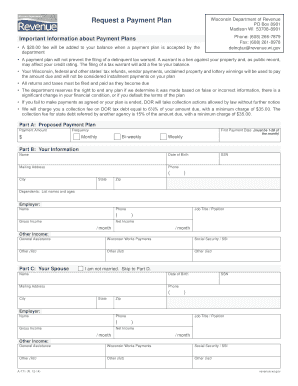

Tips on how to fill out, edit and sign WI A-771 online

How to fill out and sign WI A-771 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can become a major issue and a considerable nuisance if proper help is not provided.

US Legal Forms is designed as an online resource for WI A-771 e-filing and presents numerous advantages for taxpayers.

Click the Done button in the top menu once you have finished. Save, download, or export the completed document. Use US Legal Forms to ensure secure and straightforward completion of the WI A-771.

- Locate the template on the website within the specific section or by using the search feature.

- Click the orange button to access it and wait for it to load.

- Examine the blank and follow the provided directions. If you have not filled out the template before, stick to the step-by-step instructions.

- Focus on the highlighted fields. They are editable and require specific information to be entered. If you are uncertain about what information to input, refer to the guidelines.

- Always sign the WI A-771. Utilize the integrated tool to create your electronic signature.

- Tap the date field to automatically insert the appropriate date.

- Review the template to verify and modify it before submission.

How to modify Get WI A-771 2014: personalize forms online

Put the correct document management features at your disposal. Carry out Get WI A-771 2014 with our dependable solution that merges editing and electronic signature functionality.

If you wish to execute and sign Get WI A-771 2014 online effortlessly, then our internet-based cloud option is the ideal choice. We provide a rich template-centered catalog of ready-to-edit documents that you can modify and complete online. Additionally, there’s no need to print the form or utilize external solutions to make it fillable. All essential capabilities will be accessible for you to use as soon as you access the document in the editor.

Let’s explore our online editing functionalities and their primary characteristics. The editor features an intuitive interface, so it won't take much time to understand how to operate it. We’ll review three major sections that allow you to:

In addition to the features noted above, you can safeguard your document with a password, incorporate a watermark, transform the document into the necessary format, and much more.

Our editor simplifies modifying and certifying Get WI A-771 2014. It enables you to accomplish virtually everything regarding document handling. Furthermore, we consistently ensure that your document editing experience is safe and adheres to major regulatory standards. All these factors enhance your experience with our tool.

Obtain Get WI A-771 2014, implement the required edits and alterations, and download it in your preferred file format. Give it a try today!

- Edit and annotate the template

- The upper toolbar contains features that assist you in emphasizing and obscuring text, omitting images and graphical elements (lines, arrows and checkmarks, etc.), appending your signature, initializing, dating the document, and more.

- Organize your documents

- Employ the toolbar on the left if you wish to rearrange the document or delete pages.

- Prepare them for distribution

- If you aim to make the template fillable for others and share it, you can utilize the tools on the right to add various fillable fields, signature and date, text box, etc.

Related links form

Your charitable contributions can be tax-deductible, depending on the organization and your state laws. In Wisconsin, donations to qualified charities allow you to reduce your taxable income. It is essential to obtain proper documentation for your donations. Familiarize yourself with the guidelines under WI A-771 for a clear understanding of your eligibility.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.