Loading

Get Wi A-771 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI A-771 online

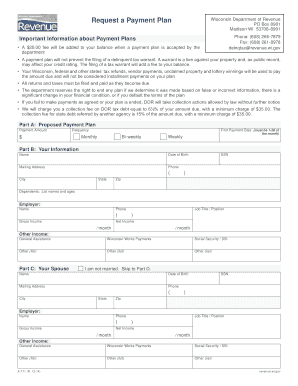

Filling out the WI A-771 form online is a straightforward process that helps you to request an installment agreement with the Wisconsin Department of Revenue. This guide will walk you through the necessary steps to complete the form accurately and efficiently.

Follow the steps to successfully complete the WI A-771 form.

- Click ‘Get Form’ button to download the WI A-771 form and access it in your preferred online editing tool.

- Begin by entering your personal information in the 'Your Information' section. Provide your full name, Social Security number, date of birth, address, city, state, zip code, and phone number. If applicable, include the names and ages of your dependents.

- Fill in the 'Spouse Information' section with similar details as above, if you are applying jointly. Ensure to list their full name, Social Security number, date of birth, address, city, state, zip code, phone number, and dependents' information.

- In the 'Place of Employment' section, provide details of your job including company name, address, phone number, job title or position, gross income, and net income. Repeat this for your spouse if applicable.

- Report any additional income you receive by completing the 'Other Income' sections. Indicate the type of income, such as General Assistance or Social Security, and the frequency of payment.

- Outline your proposed installment agreement by specifying the payment amount and frequency (monthly, semi-monthly, bi-weekly, or weekly). Select the date for automatic withdrawals if applicable.

- Thoroughly read through the 'Installment Agreement Terms' and confirm that you understand them before proceeding.

- Sign and date the document along with your spouse if you are filing jointly. Make sure the signature matches the name provided in the personal information section.

- Once all information has been accurately entered, review the form for any errors. You can save your changes, download the form for your records, or print it directly.

- Finally, submit your completed form as instructed to the Wisconsin Department of Revenue for further processing.

Get started with filling out your documents online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To establish a payment plan with Wisconsin state taxes, you can complete the application process on the Department of Revenue's website. Ensure that you have all necessary information ready, which includes your tax details. Additionally, consulting WI A-771 may assist in simplifying the steps to align your payment objectives with state requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.